DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-1

VOLUME 1, CHAPTER 1: “CHIEF FINANCIAL OFFICER OF THE DEPARTMENT

OF DEFENSE”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated December 2020 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

Administrative updates to include clarifying language in

accordance with Department of Defense Financial

Management Regulation (FMR) Revision Standard

Operating Procedures.

Revision

7.1

The Office of Deputy Comptroller (Program/Budget)

reorganized the Directorate for Integration from a directorate

to an office.

Revision

7.2

Added Deputy Comptroller for Enterprise Financial

Transformation

Addition

7.3.2

Language for the Focus Leadership Execution Team was

incorporated into paragraph 7.3.2.

Revision

Figure 1-1

Updated the Under Secretary of Defense (Comptroller)/CFO

Structure.

Revision

1.2.10,

7.3.2

This revision incorporated part of the Deputy Chief Financial

Officer memorandum titled, “Department of Defense

Component Level Accounts Responsibilities (FPM24-03),”

dated April 9, 2024.

Revision

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-2

Table of Contents

VOLUME 1, CHAPTER 1: “CHIEF FINANCIAL OFFICER OF THE DEPARTMENT OF

DEFENSE” ..................................................................................................................................... 1

1.0 GENERAL......................................................................................................................... 3

1.1 Purpose ........................................................................................................................... 3

1.2 Authoritative Guidance .................................................................................................. 3

2.0 CHIEF FINANCIAL OFFICER APPOINTMENT .......................................................... 3

3.0 ROLES AND RESPONSIBLITIES .................................................................................. 4

3.1 Financial Management ................................................................................................... 4

3.2 Financial Management Systems ..................................................................................... 4

3.3 Agency Financial Report ................................................................................................ 5

3.4 Budget Execution ........................................................................................................... 5

3.5 Biennial Review ............................................................................................................. 6

4.0 CHIEF FINANCIAL OFFICER AUTHORITY ............................................................... 6

4.1 Title 10 United States Code ........................................................................................... 6

4.2 Title 31 United States Code ........................................................................................... 6

5.0 CHIEF FINANCIAL OFFICERS COUNCIL ................................................................... 7

6.0 ESTABLISHMENT OF THE DEPUTY CHIEF FINANCIAL OFFICER ...................... 7

7.0 DEPARTMENT OF DEFENSE STAFF ORGANIZATIONS ......................................... 7

*7.1 Deputy Comptroller (Program/Budget) ...................................................................... 7

*7.2 Deputy Comptroller for Enterprise Financial Transformation ................................... 8

7.3 Deputy Chief Financial Officer ...................................................................................... 8

7.4 Director, Defense Finance and Accounting Service ...................................................... 9

7.5 Director, Defense Contract Audit Agency ................................................................... 10

8.0 DEPARTMENT OF DEFENSE COMPONENTS ......................................................... 10

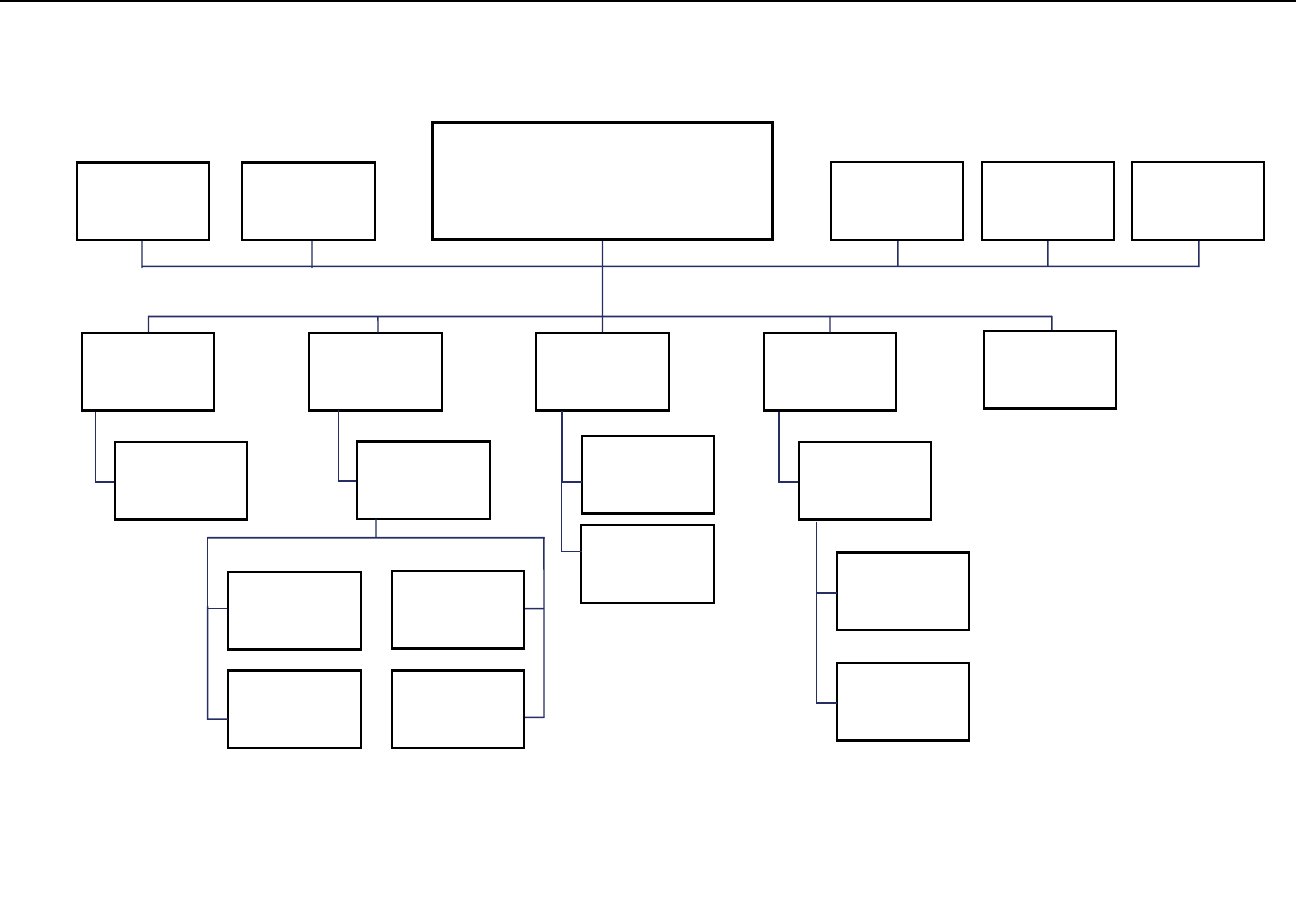

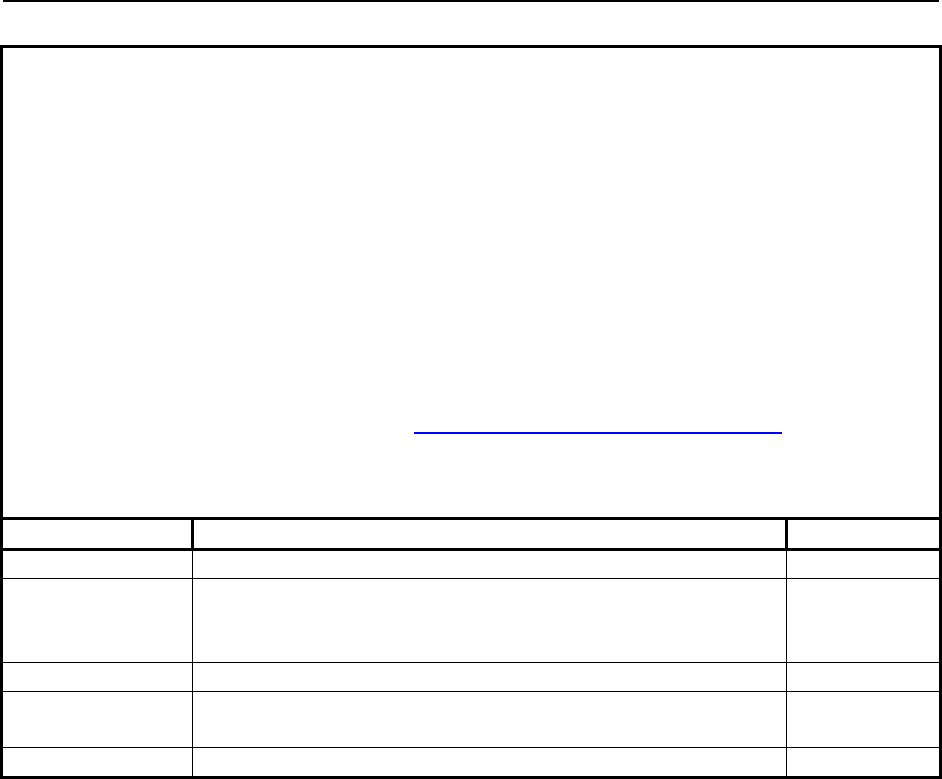

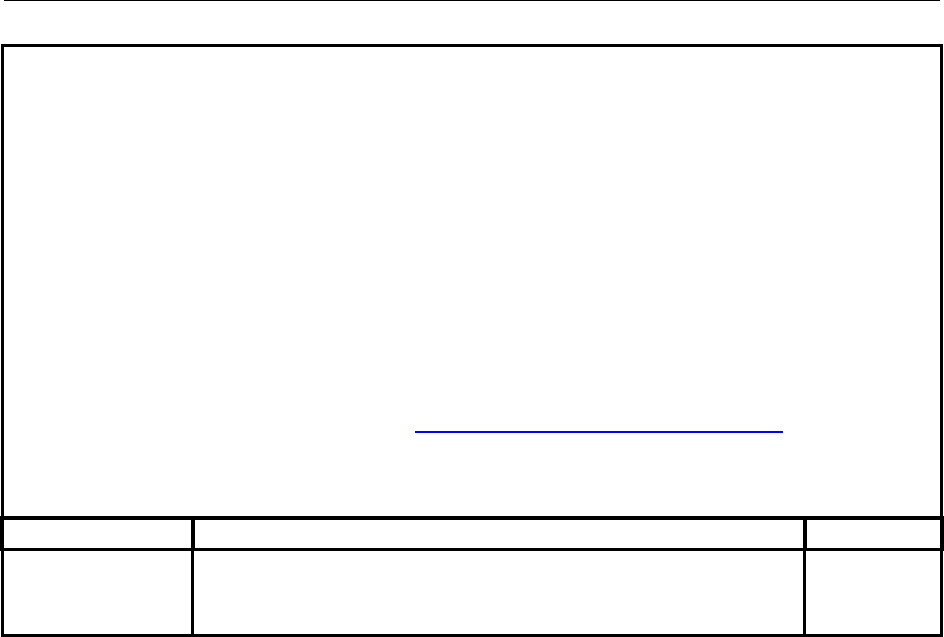

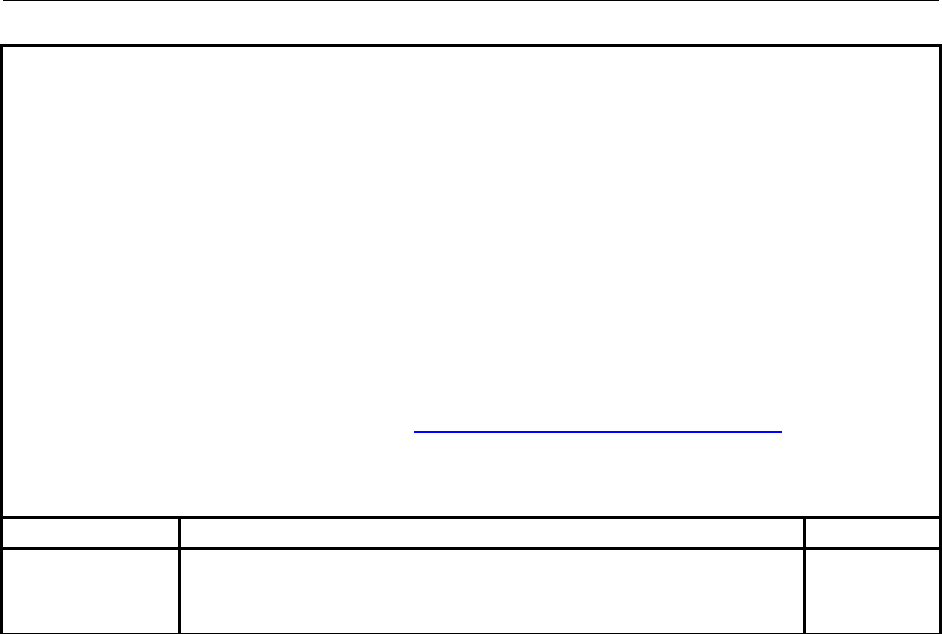

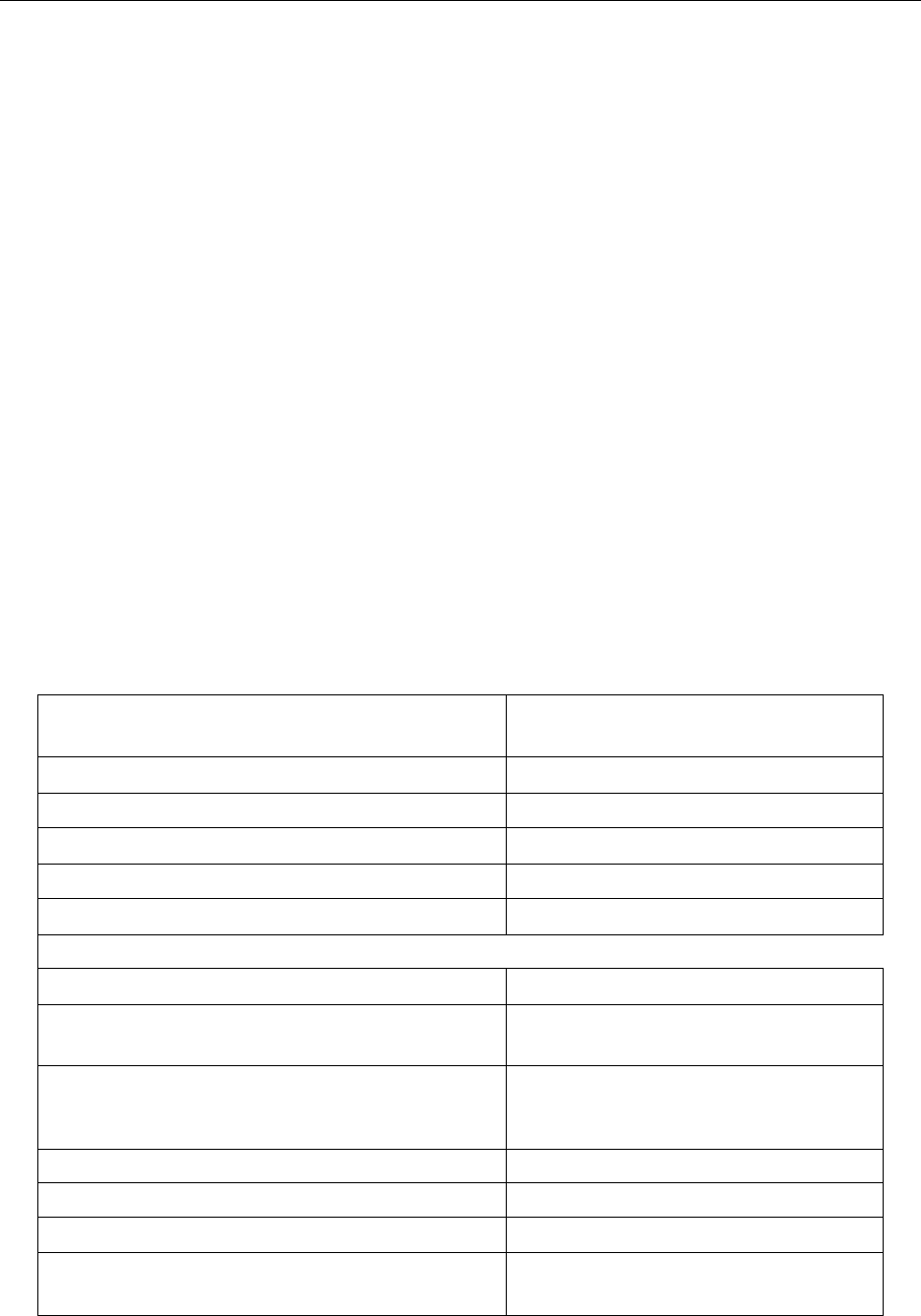

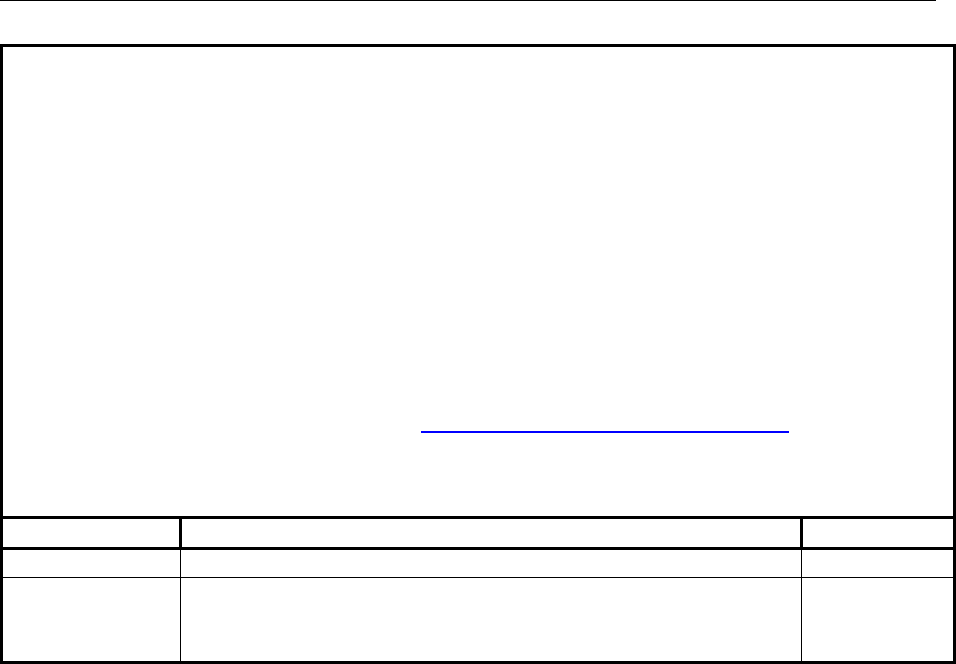

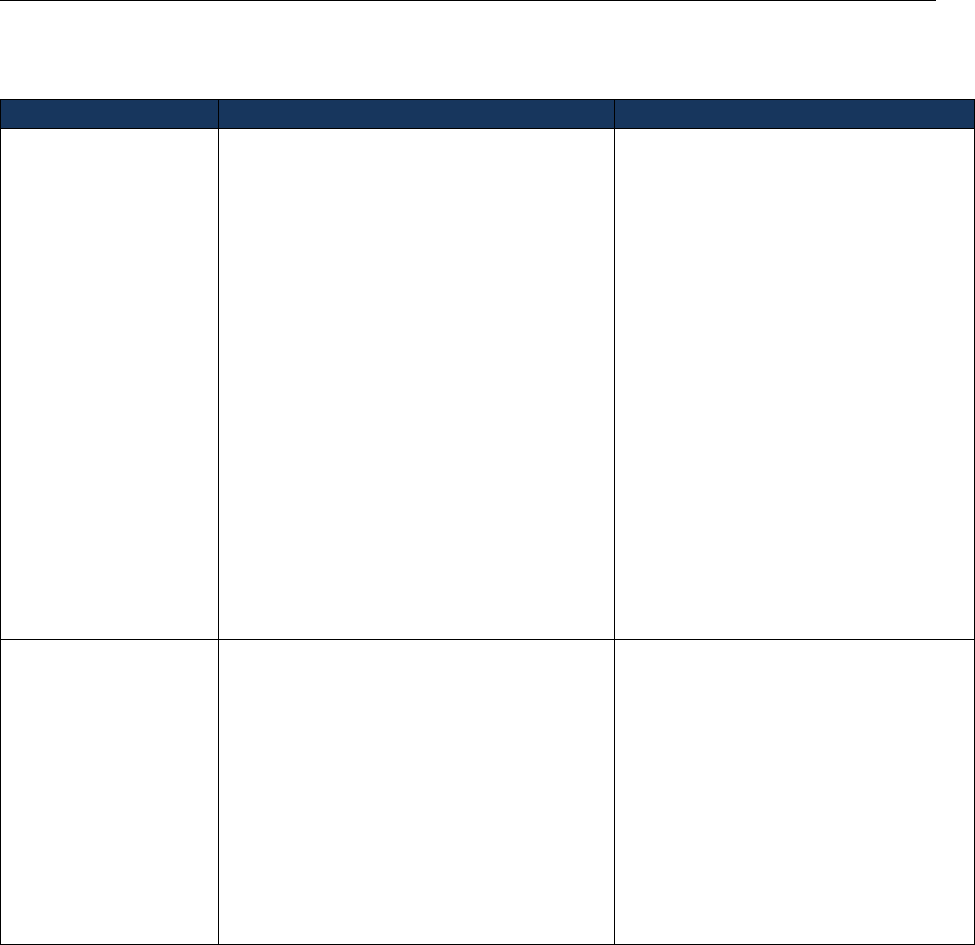

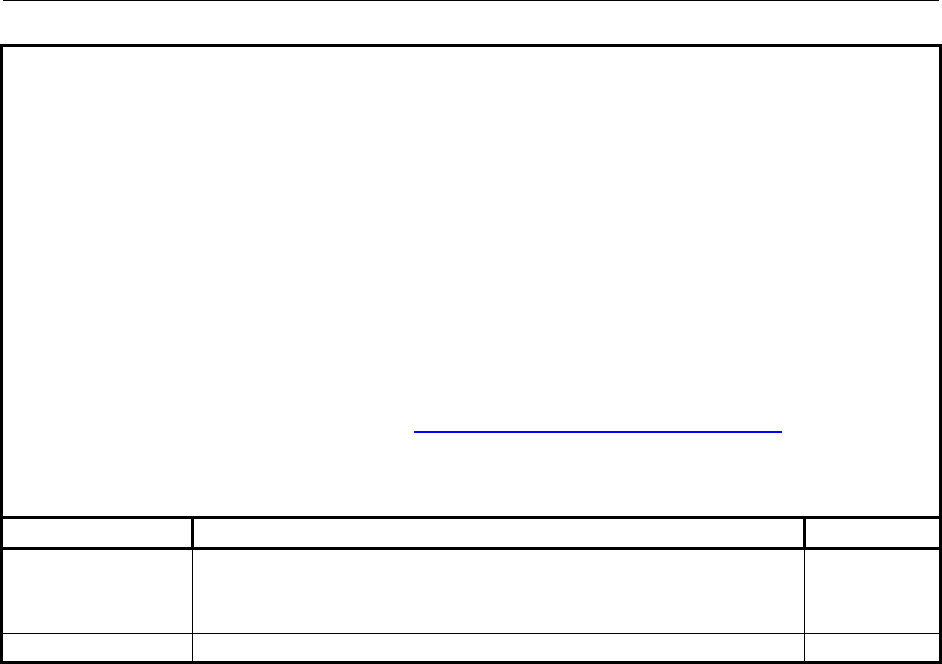

*Figure 1-1: UNDER SECRETARY OF DEFENSE (COMPTROLLER)/CHIEF FINANCIAL

OFFICER STRUCTURE .......................................................................................................... 11

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-3

CHAPTER 1

CHIEF FINANCIAL OFFICER OF THE DEPARTMENT OF DEFENSE

1.0 GENERAL

1.1 Purpose

This chapter describes the establishment, roles, responsibilities, and authority of the

Department of Defense (DoD) Chief Financial Officer (CFO) as established by the

CFO Act of 1990. The DoD CFO is also the Under Secretary of Defense (Comptroller) (USD(C).

The USD(C)/CFO is responsible for developing and implementing DoD-wide financial management

systems and overseeing financial management activities relating to CFO programs and operations.

1.2 Authoritative Guidance

The CFO establishment, roles, responsibilities, and authority prescribed are in accordance

with the applicable provisions of the following sources:

1.2.1. Title 10, United States Code, section 192 (10 U.S.C. § 192), “Defense Agencies and

Department of Defense Field Activities: oversight by the Secretary of Defense”;

1.2.2. 10 U.S.C. § 2222, “Defense business systems: business process reengineering;

enterprise architecture; management”;

1.2.3. 31 U.S.C. § 3515, “Financial statements of agencies”;

1.2.4. 31 U.S.C. § 901, “Establishment of agency Chief Financial Officers”;

1.2.5. 31 U.S.C. § 902, “Authority and functions of agency Chief Financial Officers”;

1.2.6. 31 U.S.C. § 903, “Establishment of agency Deputy Chief Financial Officers”;

1.2.7. DoD Directive (DoDD) 5105.36, “Defense Contract Audit Agency”;

1.2.8. DoDD 5118.03, “Under Secretary of Defense (Comptroller)/Chief Financial Officer,

Department of Defense (USD(C)/CFO)”;

1.2.9. DoDD 5118.05, "Defense Finance and Accounting Service (DFAS)"; and

* 1.2.10. DoD Instruction 7000.14, “DoD Financial Management Policy”.

2.0 CHIEF FINANCIAL OFFICER APPOINTMENT

The CFO Act designates DoD as an agency whose CFO is either appointed by the President,

by and with the advice and consent of the U.S. Senate; or designated by the President, in consultation

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-4

with the head of the agency, from among officials of the agency who are required by law to be so

appointed. The USD(C), who is appointed by the President and confirmed by the U.S. Senate, is

also the DoD CFO. The USD(C)/CFO must be appointed or designated, as applicable, from among

individuals who possess demonstrated ability in general management of, knowledge of, and

extensive practical experience in financial management practices in large governmental or business

entities.

3.0 ROLES AND RESPONSIBLITIES

The USD(C)/CFO is the Principal Staff Assistant and advisor to the Secretary of Defense for

budgetary and fiscal matters including financial management, accounting policy and systems,

managers’ internal control systems, budget formulation and execution, contract audit administration

and organization, and general management improvement programs. See Figure 1-1 for the DoD

Chief Financial Officer Structure. Consistent with the CFO Act, the following roles and

responsibilities are assigned to the USD(C)/CFO:

3.1 Financial Management

Direct, manage, and provide policy guidance and oversight of DoD financial management

activities, personnel, and operations, including:

3.1.1. Establish DoD policies including its component parts. Ensure compliance with

applicable accounting policy and standards.

3.1.2. Establish, review, and enforce internal controls, standards, and compliance guidelines.

3.1.3. Provide oversight of activities and operations including: (a) preparation and annual

revision of the Financial Improvement and Audit Remediation (FIAR) plan and (b) development of

financial management budgets.

3.1.4. Prepare and annually revise the DoD plan to implement the 5-year financial

management plan prepared by the Director of the Office of Management and Budget (OMB) and to

comply with the audited financial statements provisions of the CFO Act.

3.1.5. Recruit, select, and train personnel to execute financial management functions.

3.2 Financial Management Systems

Develop and maintain an integrated agency accounting and financial management system,

including but not limited to financial reporting, internal controls, cash management, credit

management, debt collection, and property and inventory management. In coordination with the

Director of Administration and Management (DA&M), provide for the design, development, and

installation of financial systems (as defined in the Glossary) and for management improvement

programs, especially those related to financial management. Ensure system:

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-5

3.2.1. Compliance with applicable accounting principles, standards and requirements, and

internal control standards.

3.2.2. Compliance with Director of OMB policies and requirements.

3.2.3. Provides for:

3.2.3.1. Complete, reliable, consistent, and timely budgetary and proprietary

transaction-level information in accordance with the Standard Financial Information Structure;

and recorded in general ledgers of the accounting systems of record to produce auditable budgetary,

proprietary, and managerial cost accounting reports for external and internal stakeholder use, and

which is responsive to DoD management information needs. All such financial management

systems must establish an Advancing Analytics (Advana) data sharing agreement, see Chapter 10.

3.2.3.2. Development and reporting of cost information.

3.2.3.3. Integration of accounting and budgeting information.

3.2.3.4. Financial and/or program performance data used in budget and financial

statement preparation.

3.2.3.5. Adequate controls over real property, equipment, and inventories.

3.2.3.6. Systematic measurement of performance.

3.3 Agency Financial Report

As required by OMB Circular A-136, DoD must prepare and transmit an Agency Financial

Report (AFR) to the Secretary of Defense, OMB, U.S. Department of the Treasury (Treasury), the

Government Accountability Office, and the Congress. The Department’s AFR preparation and

reporting requirements are identified in Volume 6B.

3.4 Budget Execution

3.4.1. Monitor the financial execution of the DoD budget in relation to actual expenditures,

and prepare and submit to the Secretary of Defense timely performance reports.

3.4.2. Administer and provide analysis and recommendations for the budgeting and

execution phases of the DoD Planning, Programming, Budgeting, and Execution process, utilizing

advice from the Director, Cost Assessment and Program Evaluation and the DA&M.

3.4.3. Direct the formulation and presentation of DoD budgets, the interactions with the

OMB and Congress on budgetary and fiscal matters, and the execution and control of approved

budgets. Maintain effective control and accountability over the use of all DoD financial resources.

In coordination with the DA&M, conduct analyses to increase the efficiency of defense spending.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-6

3.5 Biennial Review

Review, on a biennial basis, the fees, royalties, rents, and other charges imposed by the

Department for services and things of value it provides, and make recommendations on revising

those charges to reflect costs incurred in providing those services and things of value.

4.0 CHIEF FINANCIAL OFFICER AUTHORITY

4.1 Title 10 United States Code

In accordance with 10 U.S.C. § 2222, the USD(C) in conjunction with the DA&M must,

in consultation with the Defense Business Council (DBC), document and maintain any common

enterprise data for their respective areas of authority. Under this authority, they may also:

4.1.1. Participate in any related data governance process;

4.1.2. Extract defense business systems data as needed for priority activities and analyses;

4.1.3. When appropriate, ensure the source data is the same as that used to produce the

financial statements subject to annual audit;

4.1.4. Provide access, except as otherwise provided by law or regulation, to such data to

the Office of the Secretary of Defense, the Joint Staff, the military departments, the combatant

commands, the Defense Agencies, the DoD Field Activities, and all other DoD offices, agencies,

activities, and commands; and

4.1.5. Maintain consistent common enterprise data of their respective organizations.

4.2 Title 31 United States Code

To carry out CFO duties and responsibilities, the USD(C)/CFO has the authority to:

4.2.1. Access all records, reports, audits, reviews, documents, papers, recommendations,

or other material that are DoD property, are available to the DoD, and which relate to programs

and operations with respect to DoD CFO responsibilities.

4.2.2. Request such information or assistance from any Federal, State, or local

governmental entity as may be necessary.

4.2.3. To the extent and in such amounts as may be provided in advance by appropriations

Acts, the USD(C)/CFO may enter into contracts and other arrangements with public agencies and

with private persons for the preparation of financial statements, studies, analyses, and other

services; and make such payments as may be necessary.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-7

5.0 CHIEF FINANCIAL OFFICERS COUNCIL

The DoD CFO is a member of the Chief Financial Officers Council (CFOC) consisting of

the Deputy Director for Management of OMB, the Controller of the Office of Federal Financial

Management of OMB, the Fiscal Assistant Secretary of the Treasury, and agency CFOs. The CFOC

meets periodically to advise and coordinate the activities of its agency members on such matters as

consolidation and modernization of financial systems, improved quality of financial information,

financial data and information standards, internal controls, legislation affecting financial operations

and organizations, and other financial management matters.

6.0 ESTABLISHMENT OF THE DEPUTY CHIEF FINANCIAL OFFICER

The CFO Act requires the establishment of DoD Deputy Chief Financial Officer (DCFO),

who must report directly to the DoD CFO on financial management matters. The position of

DCFO must be a career-reserved position in the Senior Executive Service. Consistent with

qualification standards developed by, and in consultation with, the DoD CFO and the Director of

OMB, the Secretary of Defense must appoint as DoD DCFO an individual with demonstrated

ability and experience in accounting, budget execution, financial and management analysis,

systems development, and not less than 6 years practical experience in financial management at

large governmental entities.

7.0 DEPARTMENT OF DEFENSE STAFF ORGANIZATIONS

*7.1 Deputy Comptroller (Program/Budget)

The Deputy Comptroller (Program/Budget) is responsible for overseeing and implementing

budgetary functions within the DoD on a day-to-day basis. The Office of the Deputy Comptroller

(Program/Budget) is organized into four directorates:

7.1.1. The Directorate for Investment is responsible for advising the Deputy Comptroller

(Program/Budget) on all matters pertaining to: Procurement; Research, Development, Test, and

Evaluation; the National Intelligence Program; and for the Defense Acquisition Board program.

7.1.2. The Directorate for Military Personnel and Construction is responsible for advising

the Deputy Comptroller (Program/Budget) on all matters pertaining to operating and maintaining the

U.S. military force structure to include active, reserve, and retired military; Defense Health Program;

military construction; family housing; homeowners assistance; North Atlantic Treaty Organization

infrastructure; Base Realignment and Closure; and Real Property Maintenance.

7.1.3. The Directorate for Operations is responsible for advising the Deputy Comptroller

(Program/Budget) on all matters pertaining to operating and maintaining the U.S. military force

structure to include active and reserve military personnel and civilian personnel. This directorate is

also responsible for advising on all matters pertaining to Contingency and International programs.

7.1.4. The Directorate for Program and Financial Control is responsible for budget review

tracking, the submission of the automated defense budget for the President’s budget, maintenance of

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-8

the budget databases, apportionment of funds, reprogramming and transfer of funds, obligation and

outlay forecasting and tracking, budget concepts and scorekeeping, and information system support.

*7.2 Deputy Comptroller for Enterprise Financial Transformation

The Deputy Comptroller for Enterprise Financial Transformation (EFT) is responsible for

improving enterprise-wide performance and data-driven decision making by accelerating digital

transformation, process improvement, and the use of data and analytics. The Office for EFT is

organized into two directorates:

7.2.1. The Directorate for Digital Transformation (DT) is responsible for the oversight and

management of DoD’s financial management systems environment, including system audit

compliance, and other digital transformation efforts which leverage data, data standards,

technology, and analytics to automate and improve business processes. In alignment to the

National Defense Strategy, DT also leads the development and implementation of DoD CFO’s

Financial Management Functional Strategy to drive alignment with 21st century mission

requirements and re-investment of savings to core DoD missions.

7.2.2. The Directorate for Financial Management Operations and Analysis is responsible

for Defense-wide Working Capital Funds, the Pentagon Reservation Maintenance Revolving

Fund, the Building Maintenance Fund, the Conventional Ammunition Working Capital Fund, the

National Defense Stockpile Transaction Fund, and the Military Services' Management and Trust

Funds. The directorate also supports the migration of all legacy DoD Fund Balance with Treasury

(FBwT) reconciliations into the Advana platform, the ongoing development, operation, and

maintenance of the Department’s FBwT reconciliations with Advana, developing, implementing,

and sustaining the Dormant Account Review Quarterly process, producing a supportable Universe

of Transactions for financial statement line-item balances, analysis and reporting on budgetary and

financial execution data, and executing other Financial Management Analytics missions as needed.

7.3 Deputy Chief Financial Officer

The DCFO is responsible for overseeing and implementing accounting policy, improvements

in financial management, as well as other financial management functions for the DoD on a

day-to-day basis. The Office of the DCFO is organized into two directorates:

7.3.1. The Directorate for FIAR is responsible for audit oversight, management, and liaison

functions; supporting Components to remediate findings and achieve post-audit sustainment. FIAR

develops and annually revises a detailed FIAR Plan that identifies financial process, system, and

statement deficiencies and provides detailed corrective actions to address those deficiencies.

Additionally, FIAR manages the Defense-wide Statement of Assurance process by monitoring and

reporting the status of auditor and manager-identified material weaknesses and corrective action

plans; implementing the Federal Manager’s Financial Integrity Act program for DoD to include

OMB Circular A-123, Appendix A, “Management of Reporting and Data Integrity Risk;” managing

the Improving Financial Performance Initiative of the President’s Management Agenda; and

advocating for the USD(C)/CFO on various interagency forums and internal DoD councils, boards,

committees, and external organizations as required.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-9

* 7.3.2. The Directorate for Financial Management Policy and Reporting (FMPR) is

responsible for developing, promulgating, implementing, and interpreting DoD-wide accounting

and finance policies; supporting the USD(C)/CFO and DCFO on various interagency forums;

advocating for the USD(C)/CFO on various interagency organizations, and representing the

USD(C)/CFO on various internal DoD councils, boards and committees pertaining to financial

management policy. In addition, FMPR provides oversight of and liaisons with DoD Components

on financial management operations, systems, responses to audit reports, policy clarifications, and

other financial matters; and administers this Regulation. The Directorate develops and issues the

DoD AFR (see Volume 6B), oversees the DoD-wide consolidated financial statements and notes—

to include Component Level Account transactions—and manages the DoD Payment Integrity and

Antideficiency Act programs, and other external financial reporting. Additionally, the Directorate

supports the CFO and DCFO’s strategic vision for a strong internal control environment by

facilitating DoD implementation of large-scale, end-to-end financial and business process and/or

system adoption, and removing barriers from DoD, other federal, and industry stakeholders for

more efficient interoperable systems, data standards, and Government-wide accounting best

practices.

7.4 Director, Defense Finance and Accounting Service

The Director of DFAS is the principal DoD executive for finance and accounting

requirements, systems, and functions under the authority and direction of the USD(C). DFAS:

7.4.1. Directs and oversees finance and accounting requirements, systems, and functions for

all appropriated, nonappropriated, working capital, revolving, and trust fund activities, including

security assistance.

7.4.2. Establishes and enforces requirements, principles, standards, systems, procedures,

processes, and practices necessary to comply with finance and accounting statutory and regulatory

requirements applicable to the DoD.

7.4.3. Provides professional finance and accounting services for DoD Components and other

Federal agencies, as designated by the USD(C)/CFO.

7.4.4. Directs the consolidation, standardization, and integration of finance and accounting

requirements, functions, procedures, operations, and systems and ensures proper relationship with

other DoD functional areas (e.g., budget, personnel, logistics, acquisition, and civil engineering).

7.4.5. Executes statutory and regulatory financial reporting requirements and provides

financial statements, pursuant to 31 U.S.C. § 3515, to include supporting customers’ audit

assertions and audit execution.

7.4.6. Provides advice and recommendations to the USD(C)/CFO on finance and accounting

matters and provides documentation that discloses the internal controls within DFAS-assigned

systems that may impact customers’ control environment in supporting auditability.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-10

7.4.7. Coordinates on the establishment of all DoD finance and accounting activities

independent of the DFAS and supports the development and implementation of a compliant

business solution with common business processes and data standards for horizontal end-to-end

processes in the Business Enterprise Architecture.

7.5 Director, Defense Contract Audit Agency

The Director of Defense Contract Audit Agency (DCAA) is under the authority, direction,

and control of the USD(C)/CFO, pursuant to 10 U.S.C. § 192, DoDD 5118.03, and DoDD 5105.36.

The Director exercises authority, direction, and control over DCAA and all assigned resources.

DCAA performs all necessary DoD contract audits and provides accounting and financial advisory

services regarding contracts and subcontracts. DCAA executes the following:

7.5.1. Assists procurement and contract administration officials in achieving the objective

of prudent contracting by providing financial information and advice on proposed or existing

contracts and contractors, as appropriate.

7.5.2. In accordance with Government Auditing Standards, the Federal Acquisition

Regulation, the Defense Federal Acquisition Regulation Supplement (DFARS), and other

applicable laws and regulations, to the extent and manner considered necessary, to permit proper

performance of the other functions; DCAA audits, examines, and reviews:

7.5.2.1. Contractors’ and subcontractors’ records, documents, and other evidence;

7.5.2.2. Systems of internal control;

7.5.2.3. Compliance with regulations; and

7.5.2.4. Accounting, costing and general business practices and procedures.

7.5.3. Audits compliance with DFARS Contractor Business Systems Clauses for

contractors' accounting, material management and accounting, and estimating systems.

7.5.4. Directs audit reports to the Government management level having authority and

responsibility to act on the audit findings and recommendations.

7.5.5. As an advisor, attends and participates, as appropriate, in contract negotiation and

other meetings where contract costs, audit reports, or related financial matters are under

consideration.

8.0 DEPARTMENT OF DEFENSE COMPONENTS

The Heads of the DoD Components must direct and manage financial management activities

within their respective Components, consistent with the policies, requirements, principles, standards,

procedures, and practices prescribed by the USD(C)/CFO, and other internal policies as prescribed

by the Heads of the other DoD Components.

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 1

* June 2024

1-11

*Figure 1-1: UNDER SECRETARY OF DEFENSE (COMPTROLLER)/CHIEF FINANCIAL OFFICER STRUCTURE

Deputy Comptroller

(Budget &

Appropriations Affairs)

Assistant Deputy

Comptroller (Budget &

Appropriations Affairs)

Deputy Comptroller

(Program/Budget)

Deputy Chief Financial

Officer

Assistant Deputy Chief

Financial Officer

Director, Human

Capital & Resource

Management

Director, Financial

Management Policy &

Reporting

Director, Financial

Improvement & Audit

Remediation

Deputy Comptroller for

Enterprise Financial

Transformation

Director, Defense

Finance & Accounting

Service

Director, Defense

Contract Audit Agency

Under Secretary of Defense (Comptroller)/

Chief Financial Officer

Deputy Under Secretary of Defense (Comptroller)

Chief of Staff

Assistant Deputy

Comptroller

(Program/Budget)

Director, Operations

Director, Program &

Financial Control

Director, Military

Personnel & Construction

Director, Investment

Director, Digital

Transformation

Senior Military

Assistant

Military Assistant

Special Assistant

Director, Financial

Management Operations

& Analysis

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-1

VOLUME 1, CHAPTER 2: “FEDERAL ACCOUNTING STANDARDS HIERARCHY”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated May 2020 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

This chapter is certified as current. No revision necessary. Current

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-2

Table of Contents

VOLUME 1, CHAPTER 2: “FEDERAL ACCOUNTING STANDARDS HIERARCHY” ........ 1

1.0 GENERAL......................................................................................................................... 3

1.1 Overview ........................................................................................................................ 3

1.2 Purpose ........................................................................................................................... 3

1.3 Authoritative Guidance .................................................................................................. 3

2.0 HIERARCHY .................................................................................................................... 4

2.1 Hierarchy of Accounting Standards ............................................................................... 4

2.2 Other Pronouncements and Practices ............................................................................. 5

3.0 COMMUNICATION AND COORDINATION ............................................................... 5

3.1 Guidance and Clarification ............................................................................................. 5

3.2 Correspondence .............................................................................................................. 5

3.3 Task Force Participation................................................................................................. 6

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-3

CHAPTER 2

FEDERAL ACCOUNTING STANDARDS HIERARCHY

1.0 GENERAL

1.1 Overview

The Federal Accounting Standards Advisory Board (FASAB) is the body designated by

the American Institute of Certified Public Accountants (AICPA) as the source of generally

accepted accounting principles (GAAP) for federal reporting entities. As such, the FASAB is

responsible for identifying the sources of accounting principles and providing federal entities with

a framework for selecting the principles used in the preparation of general purpose financial reports

that are presented in conformity with GAAP. FASAB promulgates accounting standards for U.S.

government agencies after considering financial and budgetary information needs of Congress,

executive agencies, and other users of federal financial information. FASAB considers comments

from the public on its proposed Statements, which are widely distributed as “exposure drafts.”

FASAB publishes adopted statements as Statement of Federal Financial Accounting Standards

(SFFAS) that become GAAP for federal government entities. FASAB Standards and other FASAB

authoritative publications, including FASAB Interpretations, Technical Bulletins, and Technical

Releases are published on the FASAB website. Documents recently issued and not yet codified are

also presented at this location.

1.2 Purpose

1.2.1. This chapter includes the FASAB hierarchy of accounting principles and standards.

These standards are used to promulgate accounting and financial reporting policy within the

Department of Defense (DoD) Financial Management Regulation (FMR). The purpose of these

principles and standards is to improve the usefulness of federal financial reports.

1.2.2. The provisions of this chapter apply to all DoD Components, including the Defense

Working Capital Fund activities. However, this chapter does not apply to Nonappropriated Fund

(NAF) accounting. NAF accounting policies are in Volume 13.

1.2.3. Interim policies and guidance issued by the Office of the Under Secretary of

Defense (Comptroller) (OUSD(C)) through various memoranda can be found on the OUSD(C)

DoD FMR website. Such interim guidance will be incorporated into the DoD FMR once it is

finalized.

1.3 Authoritative Guidance

1.3.1. The Chief Financial Officers (CFO) Act of 1990, as amended, requires federal

financial managers, accountants and auditors to apply appropriate accounting principles and

standards.

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-4

1.3.2. FASAB develops accounting standards and principles for the United States

Government.

1.3.3. The AICPA Code of Professional Conduct, Part 1.320.020 recognized FASAB as

the board that promulgates GAAP for federal entities.

1.3.4. SFFAS 34 “The Hierarchy of Generally Accepted Accounting Principles, Including

the Application of Standards Issued by the Financial Accounting Standards Board” identifies the

GAAP hierarchy for federal reporting entities.

1.3.5. The Government Management Reform Act of 1994 (GMRA) mandates executive

agencies prepare their financial statement in accordance with GAAP.

2.0 HIERARCHY

2.1 Hierarchy of Accounting Standards

2.1.1. The SFFASs are GAAP applicable to the federal government and must be followed

by all federal agencies in reporting under the GMRA. DoD Components must adhere to the GAAP

hierarchy prescribed in SFFAS 34. The sources of accounting principles that are generally

accepted are categorized in descending order of authority as follows:

2.1.1.1. FASAB SFFAS and Interpretations;

2.1.1.2. FASAB Technical Bulletins and, if specifically made applicable to federal

reporting entities by the AICPA and cleared by FASAB, AICPA Industry Audit and Accounting

Guides. Such pronouncements specifically made applicable to federal reporting entities are

presumed to have been cleared by FASAB, unless the pronouncement indicates otherwise;

2.1.1.3. Technical Releases of the Accounting and Auditing Policy Committee

(AAPC) of the FASAB; and

2.1.1.4. Implementation guides published by FASAB staff, as well as practices that

are widely recognized and prevalent in the federal government.

2.1.2. If the accounting treatment for a transaction or event is not specified by a

pronouncement or established in practice as described in subparagraph 2.1.1., a federal reporting

entity should first consider accounting principles for similar transactions or events within

categories in subparagraphs 2.1.1 before considering Other Accounting Literature discussed in

paragraph 2.2.

2.1.3. A federal reporting entity should not follow the accounting treatment specified in

accounting principles for similar transactions or events in cases in which those accounting

principles either, (a) specifically prohibit the application of the accounting treatment to the

particular transaction or event or (b) indicate that the accounting treatment should not be applied

to other transactions or events by analogy.

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-5

2.2 Other Pronouncements and Practices

2.2.1. Other Accounting Literature includes

2.2.1.1. FASAB Concepts Statements;

2.2.1.2. AICPA Industry Audit and Accounting Guides that have not specifically

been made applicable to federal reporting entities by FASAB;

2.2.1.3. Pronouncements of other accounting and financial reporting standards-

setting bodies, such as Financial Accounting Standards Board, Governmental Accounting

Standards Board, the International Accounting Standards Board, and the International Public

Sector Accounting Standards Board;

2.2.1.4. Publications of professional associations or regulatory agencies; and

2.2.1.5. Accounting textbooks, handbooks, and articles.

2.2.2. The appropriateness of other accounting literature depends on its relevance to

particular circumstances, the specificity of the guidance, and the general recognition of the issuer

or author as an authority. FASAB Concepts Statements would normally be more influential than

other sources in this category.

3.0 COMMUNICATION AND COORDINATION

3.1 Guidance and Clarification

To ensure the consistent application of SFFAS throughout DoD, the OUSD(C), Office of

the Deputy Chief Financial Officer (ODCFO), Financial Management Policy and Reporting

(FMPR) Directorate must be contacted when clarification, technical guidance, implementation

guidance or other information regarding federal accounting standards is needed.

3.2 Correspondence

3.2.1. Formal and informal requests addressed to FASAB or the AAPC for an

interpretation, clarification, technical guidance, implementation guidance or other information

regarding SFFAS must be submitted through the OUSD(C), ODCFO, FMPR Directorate.

3.2.2. All correspondence presenting a DoD position on FASAB Exposure Drafts and on

any other matters before FASAB or the AAPC will be signed by either the DoD CFO, DCFO or

ADCFO.

3.2.3. Individuals submitting responses to exposure drafts will clearly indicate in the

correspondence that the opinions expressed are those of the individual and do not represent the

official position of DoD.

2BDoD 7000.14-R Financial Management Regulation Volume 1, Chapter 2

* September 2022

2-6

3.2.4. The Office of the Director of National Intelligence (ODNI) is not a component of

DoD and, accordingly, may communicate with accounting standards-setting bodies in the same

manner as other federal agencies. DoD components, including the Defense Intelligence Agency,

the National Geospatial-Intelligence Agency, and the National Security Agency, provide input into

ODNI correspondence with accounting standards-setting bodies. DoD Components should ensure

that ODNI communications are not presented as official DoD positions. Further, to ensure the

completeness of DoD communications, any DoD component input into ODNI correspondence

with accounting standards-setting bodies should be coordinated with the ODCFO.

3.3 Task Force Participation

3.3.1. Full participation by DoD in Task Forces sponsored by FASAB and the AAPC is

critical to ensuring that DoD’s views are considered as accounting standards and guidance are

formulated. This participation includes Task Force membership, meeting attendance, participation

in group discussions, preparing draft documents, and commenting on draft Task Force documents.

3.3.2. To ensure complete coverage by DoD, Task Force participants should notify the

OUSD(C), ODCFO, Financial Improvement and Audit Remediation, and FMPR Directorates of

membership in FASAB and AAPC Task Forces. Task Force participants should also remain alert

to the fact that many issues will impact multiple DoD Components. Coordination with the FMPR

Directorate and other DoD components will ensure that DoD is properly represented as

government-wide accounting standards are formulated.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-1

VOLUME 1, CHAPTER 3: “FEDERAL FINANCIAL MANAGEMENT

IMPROVEMENT ACT COMPLIANCE”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated October 2020 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

Streamlined to remove instructional language.

Revision

1.1

Added interdependencies between Federal Financial

Management Improvement Act and other compliance

requirements.

Addition

2.0

Revised definitions.

Revision

3.3

Revised and streamlined description of Compliance

Determination Framework.

Revision

4.0

Streamlined to remove instructional language.

Revision

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-2

Table of Contents

VOLUME 1, CHAPTER 3: “FEDERAL FINANCIAL MANAGEMENT IMPROVEMENT ACT

COMPLIANCE” ............................................................................................................................. 1

1.0 GENERAL......................................................................................................................... 3

*1.1 Overview .............................................................................................................. 3

1.2 Purpose ................................................................................................................. 3

1.3 Authoritative Guidance ........................................................................................ 3

*2.0 DEFINITIONS ............................................................................................................... 4

2.1 Financial Management System ............................................................................ 4

2.2 Core Financial System ......................................................................................... 4

3.0 ACCOUNTING STANDARDS ........................................................................................ 5

3.1 System Transactions ............................................................................................. 5

3.2 FFMIA Compliance ............................................................................................. 5

*3.3 Compliance Determination Framework ............................................................... 6

*4.0 RESPONSIBILITIES ..................................................................................................... 6

4.1 Office of the Under Secretary of Defense (Comptroller) ..................................... 6

4.2 Director of Administration and Management ...................................................... 8

4.3 Components .......................................................................................................... 8

4.4 Service Organizations .......................................................................................... 9

4.5 Inspector General ................................................................................................. 9

4.6 Hosting Organizations .......................................................................................... 9

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-3

CHAPTER 3

FEDERAL FINANCIAL MANAGEMENT IMPROVEMENT ACT COMPLIANCE

1.0 GENERAL

*1.1 Overview

The Federal Financial Management Improvement Act of 1996 (FFMIA) is intended to

ensure Federal financial systems provide reliable, consistent and uniform disclosure of financial

data using accounting standards. FFMIA requires the Department of Defense (DoD or

Department) to implement and maintain financial systems that comply with Federal Financial

Management System Requirements (FFMSR), applicable Federal accounting standards, and the

United States Standard General Ledger (USSGL) at the transaction level. FFMIA requires DoD

management to annually assess and DoD auditors to report on the Department’s compliance as

part of financial statement audit reports; and determine, based on the audit report and other

information, whether the Department’s financial management systems substantially comply with

FFMIA and, if not, to develop remediation plans as applicable.

While FFMIA compliance centers on these three standards, it is not limited to them. For

example, certain FFMSR are interrelated to and depend on other standards and requirements

underpinning the Federal Managers' Financial Integrity Act, the Agency Chief Financial Officers

(CFO) Act, the Federal Information Security Management Act of 2002 (FISMA), and Office of

Management and Budget (OMB) Circular A-123 requirements.

1.2 Purpose

This chapter prescribes the Department’s policy for achieving compliance with FFMIA. It

provides the basis for the implementation of FFMIA in order for the Department to generate timely,

accurate, and useful financial information with which the Department leadership can make

informed decisions and to ensure accountability on an ongoing basis.

1.3 Authoritative Guidance

The requirements prescribed by this chapter are in accordance with the applicable

provisions of:

1.3.1. Title 10, United States Code, section 2223(a)(5) (10 U.S.C. § 2223(a)(5))

“Information technology: additional responsibilities of Chief Information Officers”

1.3.2. 31 U.S.C § 1115 “Federal Government and agency performance plans.”

1.3.3. 31 U.S.C. § 3512, “Executive agency accounting and other financial management

reports and plans”; with emphasis on sections 801 – 807 (FFMIA).

1.3.4. 31 U.S.C. Chapter 9 “Agency Chief Financial Officers.”

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-4

1.3.5. 44 U.S.C. Chapter 35, Subchapter III “Confidential Information Protection and

Statistical Efficiency.

1.3.6. 44 U.S.C. §3601, “Definition.”

1.3.7. OMB Bulletin No. 22-01, “Audit Requirements for Federal Financial Statements.”

1.3.8. OMB Circular A-123, Appendix D, "Management of Financial Management

Systems – Risk and Compliance.”

1.3.9. OMB Circular A-130, Appendix I, “Responsibilities for Protecting and Managing

Federal Information Resources.

1.3.10. Statement on Standards for Attestation Engagements No. 18,

(SSAE 18, AT-C Section 320) “Reporting on an Examination of Controls at a Service

Organization Relevant to User Entities’ Internal Control Over Financial Reporting.”

1.3.11. National Institute of Standards and Technology

(NIST) Special Publication 800-53, Revision 5, “Security and Privacy Controls for Information

Systems and Organizations.

1.3.12. U.S. Department of Treasury Financial Manual, Volume 1, Part 6, Chapter 9500

(1 TFM 6-9500), “Revised Federal Financial Management System Requirements for Fiscal

Reporting”

1.3.13. DoD Instruction (DoDI) 8510.01,”Risk Management Framework (RMF) for DoD

Systems”

*2.0 DEFINITIONS

2.1 Financial Management System

Financial management systems include the financial systems and the financial portions of

mixed systems necessary to support financial management, including automated and manual

processes, procedures, controls, data hardware, software, and support personnel dedicated to the

operation and maintenance of system functions. Both financial systems and mixed systems may

directly or indirectly trigger a financial event within the system itself or in another system, and

may be required to comply with some or all FFMSR.

2.2 Core Financial System

Core financial systems and financial systems are synonymous terms and consist of six

functional areas: general ledger management, funds management, payment management,

receivable management, cost management, and financial reporting. Core financial systems are

comprised of one or more software programs (commonly referred to as applications), that are used

for:

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-5

2.2.1. Collecting, processing, maintaining, transmitting, or reporting data about financial

events;

2.2.2. Supporting financial planning or budgeting activities;

2.2.3. Accumulating and reporting costs information; or

2.2.4. Supporting the preparation of financial statements.

3.0 ACCOUNTING STANDARDS

3.1 System Transactions

3.1.1. The Department’s financial management systems must maintain accounting data at

the transaction level. Financial management systems include both financial and mixed systems.

All DoD financial events (budgetary and proprietary) must be recorded applying the requirements

of the USSGL guidance in the TFM, and DoD USSGL transaction library (See Chapters 4 and 7

for additional guidance).

3.1.2. Every financial relevant business event that results in an automated transaction in a

core financial system must general accurate and compliant postings to all relevant budgetary and

proprietary general ledger accounts according to the rules defined in the DoD USSGL transaction

library guidance.

3.2 FFMIA Compliance

In determining whether the Department’s financial management systems substantially

comply with FFMIA, management and auditors must consider the degree to which a system’s

performance prevents the Department from meeting the specific requirements of FFMIA as listed

in paragraph 1.1. A system may be determined to be substantially compliant with FFMIA when it

meets the requirements described in OMB Circular A-123, Appendix D, Attachment 1.

3.2.1. The DoD strategy for FFMIA compliance is integrated with related efforts to

achieve auditability and maintain effective Internal Control over Reporting (ICOR) including

Internal Control over Financial Reporting (ICOFR). Documentation that supports these related

requirements also support FFMIA compliance and may be used to avoid duplication of efforts.

3.2.2. The DoD ICOFR Guide serves as a standard reference for users involved in

financial reporting internal control activities within the DoD. This includes the annual

requirements prescribed in the OMB Circular A-123, the FFMIA, and other applicable laws,

regulations, and guidance. Its companion, the DoD Financial Statement Audit Guide is a

reference for supporting internal controls based financial statement audits. A system is subject to

FFMIA if it is determined to be ICOFR relevant as defined in the DoD ICOFR Guide and performs

any business functions aligned to FFMIA compliance requirements, including the FFMSR.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-6

3.2.3. The DoD ICOFR Guide identifies the specific Federal Information System Controls

Audit Manual (FISCAM) control activities and techniques needed to address the key ICOR risk

areas most likely to impact financial reporting based on the DoD’s experience. The remaining

FISCAM control activities (identified as “Other Control Techniques for Consideration in a

Financial Statement Audit”) should be considered by Components when evaluating federal

financial systems’ compliance with laws and regulations, such as FFMIA and FISMA.

*3.3 Compliance Determination Framework

FFMIA Compliance Determination Framework (Framework) assists in providing

incremental steps and is designed to walk the user from goal through risk assessment, to

conclusion. The risk-based Framework assesses the financial systems integrity risk to comply

substantially with FFMIA Section 803(a) requirements. The Framework includes performance

results based on annual financial statements, the "Federal Financial Management System

Requirements" contained in 1 TFM 6-9500, and other information considered relevant and

appropriate. The Framework goals and compliance indicators must to be used during the ongoing

operation of the Department’s financial management systems. (See OMB Circular A-123,

Appendix D, Attachment 1 for additional guidance). The DoD ICOFR Guide defines mandatory

practices for maintaining auditability subsequent to assertion and validation. These same practices

must be applied to maintain compliance with FFMIA requirements.

*4.0 RESPONSIBILITIES

The responsibilities identified in this section are limited to those specific to FFMIA

compliance and are not meant to be an exhaustive list of all of the responsibilities of these entities.

This includes the authorities and framework that the Department employs to monitor, analyze,

validate, integrate, and control FFMIA compliance requirements.

4.1 Office of the Under Secretary of Defense (Comptroller)

4.1.1. The Office of the Under Secretary of Defense (Comptroller) (OUSD(C)) is

supported by the Enterprise Financial Transformation (EFT), the Financial Improvement and

Audit Remediation (FIAR) Directorate and the Financial Management Policy and Reporting

(FMPR) Directorate. OUSD(C) is responsible for providing a Department-wide assessment of

compliance with the requirements of FFMIA.

4.1.1.1. If the Component financial management systems do not substantially

comply with the requirements of Section 803(c), the FFMIA requires that a remediation plan be

developed, in consultation with OMB that describes the resources, remedies, and milestones for

achieving substantial compliance.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-7

4.1.1.2. OUSD(C) must annually report to OMB the progress made towards

resolving identified deficiencies and such progress must be discussed in the Components

remediation plan, capital planning and investment control plans, and other planning documents,

when applicable. The findings or analysis of noncompliance must be included with a discussion

of ongoing remediation activities. Progress towards resolving the deficiencies must not be

construed as compliance with FFMIA.

4.1.1.3. Remediation plans are expected to bring the Department’s financial

management systems into substantial compliance no later than three years after the date a non-

compliance determination is made by OUSD(C) or its auditors. However, if OUSD(C), with the

concurrence of OMB, determines that the Department’s financial management systems cannot be

brought into substantial compliance within three years, the Component (in consultation with

OUSD(C)) may specify a longer period. In either case, the Component must designate a

Component official responsible for bringing the Component’s financial management systems into

substantial compliance by the date specified and for reporting progress to EFT (acting on behalf

of the Defense Business Systems Committee) on a scheduled basis.

4.1.2. EFT:

The Organization of EFT governs the DoD Advancing Analytics (Advana)

repository of common enterprise data. See Chapter 10 for additional information about how EFT

uses Advana to support FFMIA compliance activities. EFT also acquires, incorporates, and

standardizes data to support the business domain areas that align with the organizational structure

of the Department. As a result, EFT provides reasonable assurance to consumers that data controls

are clearly defined and executed in accordance with FFMIA.

4.1.3. FIAR Directorate

The FIAR Directorate develops, publishes, and issues detailed financial

improvement audit strategies, methodologies, and implementation guidance. The FIAR Director,

monitors reporting entity FFMIA assertions made and provides internal control training to

reporting entities on improving compliance with FFMIA. As a result, the FIAR Directorate,

improves the quality of the financial information, with a positive audit opinion as the desired

outcome.

4.1.4. FMPR Directorate

The FMPR Directorate develops, publishes, implements, and interprets DoD-wide

accounting and finance policies; ensures the DoD Financial Management Regulation (DoD

7000.14-R) is consistent with laws and other applicable guidance. The FMPR Directorate, leads

and oversees DoD financial integrity. As a result, FMPR develops, publishes, and interprets DoD-

wide financial management improvements and guidance that supports statutory requirements for

the Department to audit its full set of financial statements.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-8

4.2 Director of Administration and Management

The Director of Administration and Management (DA&M) is the principal management

office for the Secretary of Defense responsible for optimizing the business environment across the

DoD enterprise. The DA&M delivers premier program management and oversight, security

services, and support functions that enable uninterrupted operations of the Department

Headquarters.

4.3 Components

4.3.1. Components must establish and maintain financial management systems that

substantially comply with FFMIA Section 803(c) requirements. Component systems must be

developed to generate reliable, timely and consistent information necessary for the Department to

comply with FFMIA requirements. DoD systems must have the ability to prepare accurate,

reliable, and timely financial statements and other required financial and budget reports using

information generated by the financial management systems. Component management must

annually test financial management systems for FFMIA compliance as required by OMB Circular

A-123, Appendix D.

4.3.2. Components must maintain records of systems and transactional data to comply

with FFMIA, financial statement audits, ICOFR, and Internal Control over Financial Systems in:

4.3.2.1. DoD Information Technology Portfolio Repository (DITPR).

Components must ensure their financial system portfolio is accurately reported in DITPR. DoD

financial systems must review, report, and update appropriately all DITPR FFMIA reporting

requirements and DoD business enterprise architecture operational activity assertions that align to

federal financial management functions on an annual bases in accordance with

10 U.S.C. § 2223(a)(5).

4.3.2.2. FIAR Systems Database (FSD). Components must utilize FSD to identify,

capture, and report on the universe of financially-relevant systems for audits, executive leadership,

and Congressional reporting requirements. Owners of each system must maintain the current

status of FFMIA compliance in FSD to support annual FFMIA compliance and Department’s

Annual SOA reporting.

4.3.2.3. Advana. Components must provide EFT with periodic (minimum

quarterly) budgetary and proprietary transactional data for uploading to Advana. See Chapter 10

for additional information.

4.3.3. Components must use 1 TFM 6-9500 in the pre-acquisition, acquisition, and

implementation of new financial management solutions (manual or automated). These federal

financial management system requirements establish uniform financial systems, standards, and

reporting that support the achievement of the DoD financial reporting objectives. In addition,

Components must use the Federal Financial Management System Requirements in accordance

with OMB Circular A-123.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 3

* September 2023

3-9

4.3.3.1. Develop a plan in accordance with OMB Circular A-130, Appendix I.

4.3.3.2. Ensure the system portfolio and remediation plans are consistent with

modernization priorities identified in 44 U.S.C. §3601.

4.3.4. Assess internal controls over business processes as well as Information Technology

General Controls (ITGC) and IT Application Controls.

4.3.5. Conduct FFMIA certification testing using the Government Accountability Office

(GAO) Financial Audit Manual, DoD ICOFR Guide, 1 TFM 6-9500 and DoD Financial Statement

Audit Guide, leveraging existing system development life-cycle activities where appropriate.

4.4 Service Organizations

Service Organizations must develop and maintain FFMIA compliance remediation plan in

coordination with DoD Components. For each financial system and mixed system managed by

Service Organizations a Memorandum of Agreement (MOA) must be established with each DoD

Component. As part of the MOA, compliance testing must be conducted to support Component

end-to-end business process testing. Service Organizations must provide Components with a

Report on Controls at a Service Organization Relevant to User Entities' Internal Control over

Financial Reporting and also known as a System and Organizational Controls 1 (SOC 1 Report).

The SOC 1 Report evaluates the effect of the controls at the service organization on the user

entities' controls for financial reporting.

4.5 Inspector General

The Office of the Inspector General performs FFMIA compliance evaluations as part of

financial statement audits and/or oversees evaluations performed by independent public

accounting firms during financial statement audits. This includes identifying in writing the nature

and extent of non-compliance when appropriate. Inspector General reports to Congress instances

and reasons when the Department has not met the intermediate target dates established in the

remediation plan required under FFMIA Section 803(c).

4.6 Hosting Organizations

Hosting Organizations provide application hosting services for the DoDs service providers.

As a result, hosting organizations are responsible for most of the ITGC over the computing

environment in which many financial, personnel, and logistics applications reside. In order for

service providers and components to rely on automated controls and documentation within these

applications, controls must be appropriately and effectively designed.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-1

VOLUME 1, CHAPTER 4: “STANDARD FINANCIAL INFORMATION

STRUCTURE”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an asterisk (*) symbol preceding the section,

paragraph, table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated October 2020 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

All

Administrative updates in accordance with Department of

Defense Financial Management Regulation Revision

Standard Operating Procedures.

Revision

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-2

Table of Contents

VOLUME 1, CHAPTER 4: “STANDARD FINANCIAL INFORMATION STRUCTURE” ..... 1

1.0 GENERAL......................................................................................................................... 3

1.1 Overview ........................................................................................................................ 3

1.2 Purpose ........................................................................................................................... 3

1.3 Authoritative Guidance .................................................................................................. 3

2.0 DEFINITIONS .................................................................................................................. 5

2.1 Business Enterprise Architecture ................................................................................... 5

2.2 Financial Management System Types............................................................................ 5

2.3 Investment Review Process ............................................................................................ 6

2.4 SFIS Business Rules ...................................................................................................... 6

2.5 SFIS Compliance Checklist ........................................................................................... 6

2.6 SFIS Values Library Service .......................................................................................... 6

2.7 Standard Data ................................................................................................................. 6

2.8 SLOA/Accounting Classification ................................................................................... 7

3.0 COMPLIANCE REQUIREMENTS ................................................................................. 7

3.1 SFIS ................................................................................................................................ 7

3.2 SLOA/Accounting Classification ................................................................................... 7

3.3 Interoperability of Data between Systems ..................................................................... 8

3.4 Defense Departmental Reporting System SFIS Trial Balance....................................... 8

4.0 ROLES AND RESPONSIBILITIES ................................................................................. 8

4.1 Office of the Under Secretary of Defense (Comptroller) ............................................... 8

4.2 Office of the Chief Information Officer ......................................................................... 8

4.3 DoD Components ........................................................................................................... 9

4.4 Defense Finance and Accounting Service ...................................................................... 9

5.0 SFIS RESOURCES ........................................................................................................... 9

Table 4-1. SFIS Compliance Summary ............................................................................... 10

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-3

CHAPTER 4

STANDARD FINANCIAL INFORMATION STRUCTURE

1.0 GENERAL

1.1 Overview

The Standard Financial Information Structure (SFIS) is a comprehensive data structure

that supports requirements for budgeting, financial accounting, cost/performance, interoperability,

and external reporting needs across the Department of Defense (DoD) enterprise. It is a common

business language that enables budgeting, performance-based management, and the generation of

financial statements. SFIS standardizes financial reporting across DoD and allows revenues and

expenses to be reported by programs that align with major goals, rather than basing reporting

primarily on appropriation categories. It also enables decision-makers to efficiently compare

programs and their associated activities and costs across DoD and provides a basis for common

valuation of DoD programs, assets, and liabilities. The SFIS matrix that defines each data element

is available on the SFIS resources web page.

1.2 Purpose

This chapter prescribes the requirements for SFIS and Standard Line of Accounting

(SLOA)/Accounting Classification compliance for DoD business systems. SFIS and

SLOA/Accounting Classification compliance provides a means for DoD business systems to meet

statutory requirements and additional requirements implemented by the Office of Management

and Budget (OMB), and the United States Department of the Treasury (Treasury).

1.3 Authoritative Guidance

1.3.1. Title 10, United States Code (U.S.C.), section 2222(e)(3) (10 U.S.C. § 2222(e)(3)),

Defense business systems: business process reengineering; enterprise architecture; management,

requires the DoD Business Enterprise Architecture (BEA) include an information infrastructure

that, at a minimum, enables DoD to:

1.3.1.1. Comply with all applicable law, including Federal accounting, financial

management, and reporting requirements;

1.3.1.2. Routinely produce verifiable, timely, accurate, and reliable business and

financial information for management purposes;

1.3.1.3. Integrate budget, accounting, and program information and systems; and

1.3.1.4. Identify whether each existing business system is a part of the business

system environment outlined by the Defense BEA, will become a part of that environment with

appropriate modification, or is not a part of that environment.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-4

1.3.2. 10 U.S.C. § 2222(e)(3)(A) requires establishment of policies, procedures, business

data standards, business performance measures, and business system interface requirements that

are applied uniformly throughout DoD.

1.3.3. 31 U.S.C. § 902(a)(3), Authority and functions of agency Chief Financial Officer,

requires agencies to develop and maintain an integrated agency accounting and financial

management system, including financial reporting and internal controls that:

1.3.3.1. Complies with applicable accounting principles standards and

requirements, and internal control standards;

1.3.3.2. Complies with such policies and requirements as may be prescribed by the

Director of OMB;

1.3.3.3. Complies with any other requirements applicable to such systems; and

1.3.3.4. Provides for:

1.3.3.4.1. Complete, reliable, consistent, and timely information which is

prepared on a uniform basis and which is responsive to the financial information needs of agency

management;

1.3.3.4.2. The development and reporting of cost information;

1.3.3.4.3. The integration of accounting and budgeting information; and

1.3.3.4.4. The systematic measurement of performance.

1.3.4. The Federal Financial Management Improvement Act of 1996 (FFMIA) requires

agencies to incorporate accounting standards and reporting objectives established for the Federal

Government into financial management systems so that all the assets and liabilities, revenues,

expenditures or expenses, and the full costs of programs and activities of the Federal Government

are consistently and accurately recorded, monitored, and uniformly reported throughout the

Federal Government.

1.3.5. The Government Performance and Results Act of 1993 (GPRA), as amended by

the GPRA Modernization Act of 2010, requires annual performance reporting that links

performance planned to performance achieved.

1.3.6. The OMB Circular A-123, Appendix D, provides FFMIA compliance guidance

including the requirement for agencies’ financial management systems to reflect an agency-wide

financial information classification structure that is consistent with the United States Standard

General Ledger (USSGL). Application of the USSGL at the transaction level means that each

time an approved transaction is recorded in a financial management system, it must generate the

appropriate general ledger accounts for posting the transaction according to the rules defined in

the USSGL guidance. OMB Circular 123, Appendix D was incorporated into Chapter 3.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-5

1.3.7. The OMB, Office of Federal Financial Management requires, within each

department or agency, standard accounting classification elements and definitions to ensure

uniform and efficient accounting treatment, classification, and reporting.

1.3.8. The Treasury Bureau of the Fiscal Service publishes the USSGL which is updated

annually in the Treasury Financial Manual (TFM). The TFM Volume 1, Supplements includes

the latest USSGL Bulletin and seven major sections that comprise the Treasury USSGL guidance:

(I) Chart of Accounts, (II) Accounts and Definitions, (III) Account Transactions, (IV) Account

Attributes for USSGL Proprietary Account and Budgetary Account Reporting, (V) Crosswalks to

Standard External Reports for Governmentwide Treasury Account Symbol Adjusted Trial Balance

System (GTAS) Reporting, (VI) Crosswalks to Reclassified Statements for Reporting, and (VII)

GTAS Validations and Edits for Reporting. The USSGL standardizes federal agency accounting

and supports the preparation of standard external reports required by the OMB and Treasury.

2.0 DEFINITIONS

2.1 Business Enterprise Architecture

The BEA is the enterprise architecture for the DoD business mission area that guides and

constrains implementation of interoperable Defense business system solutions as required by

10 U.S.C. § 2222. The BEA defines the DoD business transformation priorities, the business

capabilities required to support those priorities, and the combinations of enterprise systems and

initiatives that enable those capabilities. It is used to determine compliance for systems reviewed

by the Defense Business Council (DBC) and includes the SFIS requirements. The BEA

structure/framework was developed using a set of integrated DoD Architecture Framework

products to include the All View, Operational View, Systems and Services View, and Technical

Standards View. It includes activities, processes, data, information exchanges, business rules,

system functions, system data exchanges, terms, and linkages to laws, regulations, and policies.

2.2 Financial Management System Types

This paragraph defines DoD financial management system types in the current

environment for purposes of SFIS and SLOA/Accounting Classification compliance. See the

Glossary for a complete definition of a financial management system and Chapter 3 for definitions

of a financial system and a mixed system.

2.2.1. Target Accounting System. A target accounting system is configured to post

transactions to an internal USSGL compliant subsidiary or general ledger and does not have a

system retirement plan and date.

2.2.2. Target Financial Business Feeder System. A target financial business feeder system

creates or processes transactions with financial impacts and exchanges accounting data with

another business feeder system(s) and/or accounting system(s). This type of system does not

qualify as a target accounting system and does not have a retirement plan and date.

DoD 7000.14-R Financial Management Regulation Volume 1, Chapter 4

* June 2023

4-6

2.2.3. Legacy Accounting System. Same definition as paragraph 2.2.1 except it has a

retirement plan and date.

2.2.4. Legacy Financial Business Feeder System. Same definition as paragraph 2.2.2

except it has a retirement plan and date.

2.3 Investment Review Process

DoD implemented a business systems investment review process through the DBC. The

DBC is the principal subsidiary governance body to the Deputy's Management Action Group

(DMAG) for defense business operations. The DBC also assumes the role of the Department's

Investment Review Board (IRB) for Defense Business Systems investments. A primary goal of

the IRB process is to facilitate development and implementation of integrated business systems

across DoD business functions and capabilities; thereby providing a framework for effective

investment decision-making and enabling the Department’s senior leadership to guide investments

to maximize the impact to the warfighter. SFIS/SLOA is a critical part of this process.

2.4 SFIS Business Rules

The SFIS business rules specify how SFIS data elements must be implemented and are the

primary mechanism that drives SFIS compliance. The SFIS business rules dictate compliance

requirements such as syntax, storage, derivation and usage.

2.5 SFIS Compliance Checklist

The SFIS Compliance Checklist is based on the SFIS business rules. DoD Components

use the Checklist to document financial system compliance with the SFIS business rules. The

Checklist provides the Office of the Secretary of Defense leadership, DoD Component program

managers, and other financial and operations managers with a means for determining whether their

accounting and financial business feeder systems comply with SFIS requirements.

2.6 SFIS Values Library Service