Annual Investor Presentation

February 8, 2024

2

Disclaimer

All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell any security mentioned. Pershing Square Capital

Management, L.P. (“Pershing Square”) believes this presentation contains a balanced presentation of the performance of the portfolio it manages, including a general summary of certain

portfolio holdings that have both over and under performed our expectations.

This presentation contains information and analyses relating to all of the publicly disclosed positions over 50 basis points in the portfolio of Pershing Square Holdings, Ltd. (“PSH” or the

“Company”) during 2023. Pershing Square may currently or in the future buy, sell, cover or otherwise change the form of its investments discussed in this presentation for any reason.

Pershing Square hereby disclaims any duty to provide any updates or changes to the information contained herein including, without limitation, the manner or type of any Pershing

Square investment.

Past performance is not necessarily indicative of future results. All investments involve risk including the loss of principal. It should not be assumed that any of the transactions or

investments discussed herein were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment

performance of the investments discussed herein. Specific companies or investments shown in this presentation are meant to demonstrate Pershing Square’s active investment style

and the types of industries and instruments in which we invest and are not selected based on past performance.

The analyses and conclusions of Pershing Square contained in this presentation are based on publicly available information. Pershing Square recognizes that there may be confidential

or otherwise non-public information in the possession of the companies discussed in the presentation and others that could lead these companies to disagree with Pershing Square’s

conclusions. The analyses provided include certain statements, assumptions, estimates and projections prepared with respect to, among other things, the historical and anticipated

operating performance of the companies. Such statements, assumptions, estimates, and projections reflect various assumptions by Pershing Square concerning anticipated results that

are inherently subject to significant economic, competitive, legal, regulatory, and other uncertainties and contingencies and have been included solely for illustrative purposes. No

representations, express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials

herein. Any forward-looking statement contained in this presentation is subject to various risks and uncertainties. See also “Forward-Looking Statements” in Additional Disclaimers and

Notes to Performance Results at the end of this presentation. All trademarks included in this presentation are the property of their respective owners. This document may not be

distributed without the express written consent of Pershing Square and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product.

This presentation is expressly qualified in its entirety by reference to PSH’s prospectus which includes discussions of certain specific risk factors, tax considerations, fees and other

matters, and its other governing documents.

SEE ADDITIONAL DISCLAIMERS AND NOTES TO PERFORMANCE RESULTS AT THE END OF THIS PRESENTATION FOR ADDITIONAL IMPORTANT INFORMATION

Strategic Update

2023 PSH Performance Review

Q&A

Chairman’s Introduction

Business & Organizational Update

Agenda

Equity Portfolio Update

Chairman’s Introduction

Board of Directors of PSH

5

Summary ExperienceBoard Director

‾

Director, Caledonia Investments plc and BlueRiver Acquisition Corp.

‾

Former Director, Investec Asset Management

‾

Former Partner, Providence Equity Partners, Electra Private Equity Partners, and JF Electra Ltd

‾

Morgan Stanley (New York), Bain and Company (London)

Anne Farlow

Independent Director

Chairman of the Board

‾

Director, U.K. Office for Budget Responsibility, TwentyFour Income Fund Ltd, Mercator Media, Scottish American

Investment Co, and BH Macro Ltd

‾

Former Governor, London School of Economics

‾

Former Head of Global Research, HSBC and Former Head of European Broadcast, Bloomberg LP

‾

Nomura International, Deutsche Bank

Bronwyn Curtis, OBE

Senior Independent Director

‾

President, the Investment Manager

‾

Former CFO, the Investment Manager

‾

Former CFO, Gotham Partners

‾

Former Senior Auditor, Deloitte & Touche

Nicholas Botta

Director

‾

Chairman of the Board, Onward Opportunities Ltd, SW7 Holdings Ltd, and Butterfield Bank Jersey Ltd

‾

Director TaDaweb S.A., Longview Partners (Guernsey) Ltd, and Close Brothers Asset Management (Guernsey) Ltd

‾

Former Chairman of the Board, Boussard & Gavaudan Holding Ltd

‾

Former Director of St John Ambulance, Guernsey

Andrew Henton

Independent Director

‾

Co-Founder and Managing Partner, Helios Investment Partners

‾

Co-CEO and Director, Helios Fairfax Partners Corp (TSX:HFPC)

‾

Director, Helios Towers plc and NBA Africa

‾

Member, Harvard Law School Dean’s Advisory Board

‾

Former Member, MIT Corporation (Massachusetts Institute of Technology’s board of trustees)

Tope Lawani

Independent Director

‾

Chairman of the Board, Bremont Watch Company

‾

Trustee and Chairman of investment advisory group, Comic Relief

‾

Former Chairman and CEO of Rococo Chocolates, Former CEO of Sterling Relocation and Propertyfinder.co.uk

‾

Former Director of Thistle Hotels, English Welsh & Scottish Railways, and Graham-Field Health Products

Rupert Morley

Independent Director

Rupert Morley, upon his re-election, will replace Anne Farlow as Chairman of the

Board as of the Annual General Meeting on May 8, 2024

6

PSH Board Process

Quarterly meetings; additional meetings as needed

Review and monitor

Investment performance and portfolio

Operational risk management

Investor relations

Share price performance

Expenses

Regulatory matters

Board Committees (membership limited to independent directors

except for risk and nomination committees)

Audit Committee

Management Engagement Committee

Nomination Committee

Remuneration Committee

Risk Committee

Additional matters

7

Share buybacks

Dividend policy

Debt strategy

ESG considerations

Strategies for addressing discount to NAV

U.S. listing

PSH Board Additional Matters Considered in 2023

8

Note: PSH share price performance reflects public shares traded on Euronext Amsterdam (PSH:NA) and includes dividend reinvestment. All index returns include dividend reinvestment. Past performance is not necessarily indicative of future

results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end of this presentation.

(1) HFRX Equity Hedge Index and HFRX Activist Index are constructed and maintained by Hedge Fund Research, Inc. HFRX Equity Hedge Index includes funds that maintain long and short positions in primarily equity and equity derivative

securities and employ a broad range of fundamental and quantitative techniques in their investment process. HFRX Activist Index includes funds with activist strategies and 50%+ of portfolio in activist situations.

(2) Public shares of PSH commenced trading on Euronext Amsterdam N.V. on October 13, 2014. The annualized return of PSH share price including dividend reinvestment between October 13, 2014 and December 31, 2023 was 7.9%.

(3) As of 2/6/2024.

Overview of 2023 Performance

PSH generated 2023 NAV appreciation of 26.7% and total shareholder return of

36.0%, enhancing its substantial long-term outperformance vs. market indices

PSH’s discount to NAV narrowed by 4.5% from 33.2% in the beginning of 2023 to

28.7% at year end, and has narrowed further to 27.0% thus far in 2024

(3)

Annualized Returns

Market Indices HFRX Indices

PSH

S&P

FTSE 100

MSCI Equity

Period NAV Share Price 500 $USD £GBP World Activist Hedge

2023 26.7% 36.0% 26.3% 13.5% 7.7% 24.4% 11.5% 6.9%

3-Year 13.5% 11.3% 10.0% 7.6% 10.1% 7.8% 9.3% 5.1%

5-Year 31.2% 31.2% 15.7% 6.7% 6.7% 13.4% 12.2% 6.1%

10-Year 13.6% N/A 12.0% 2.6% 5.3% 9.2% 7.6% 2.9%

(1)

(2)

(1)

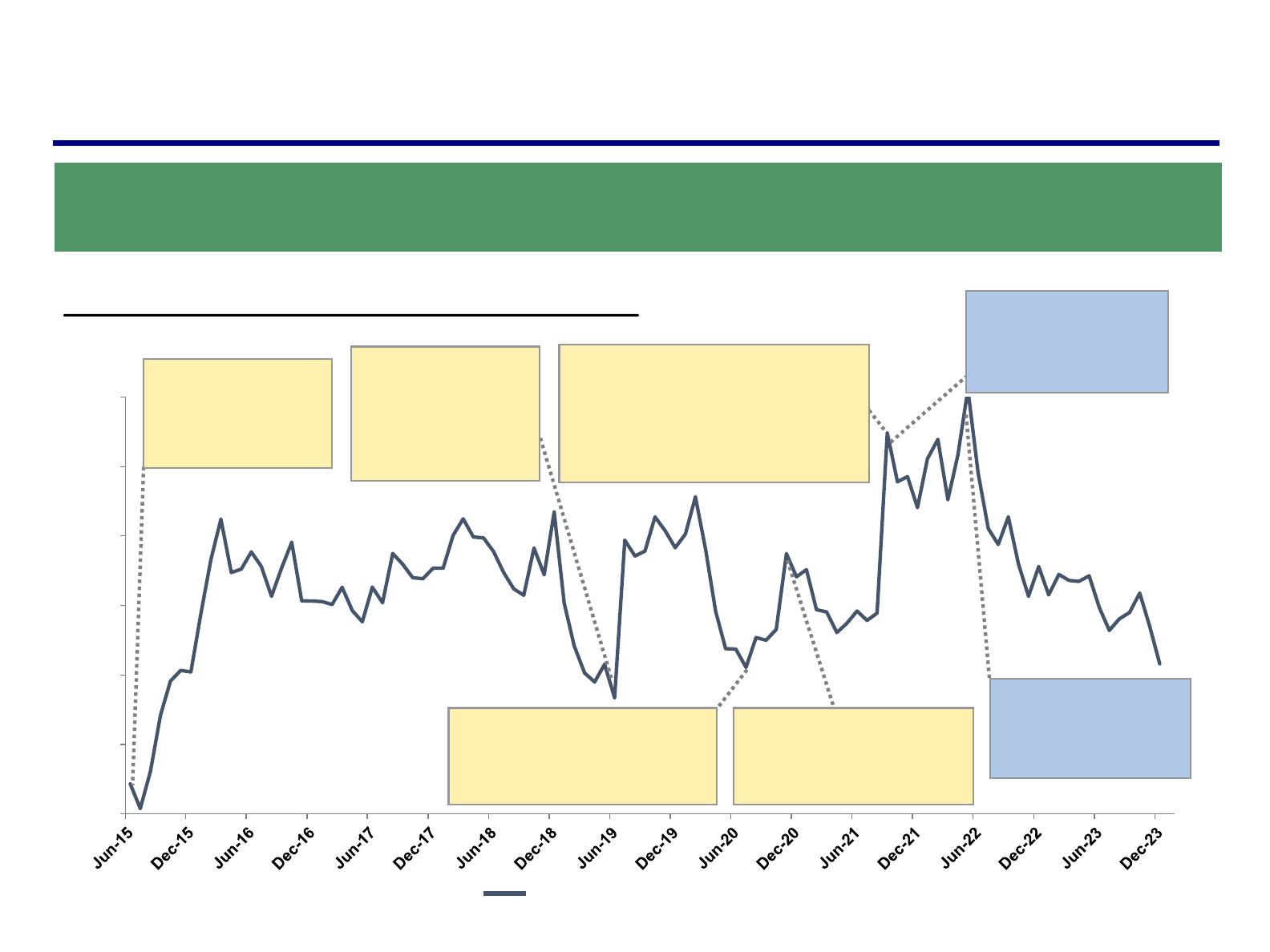

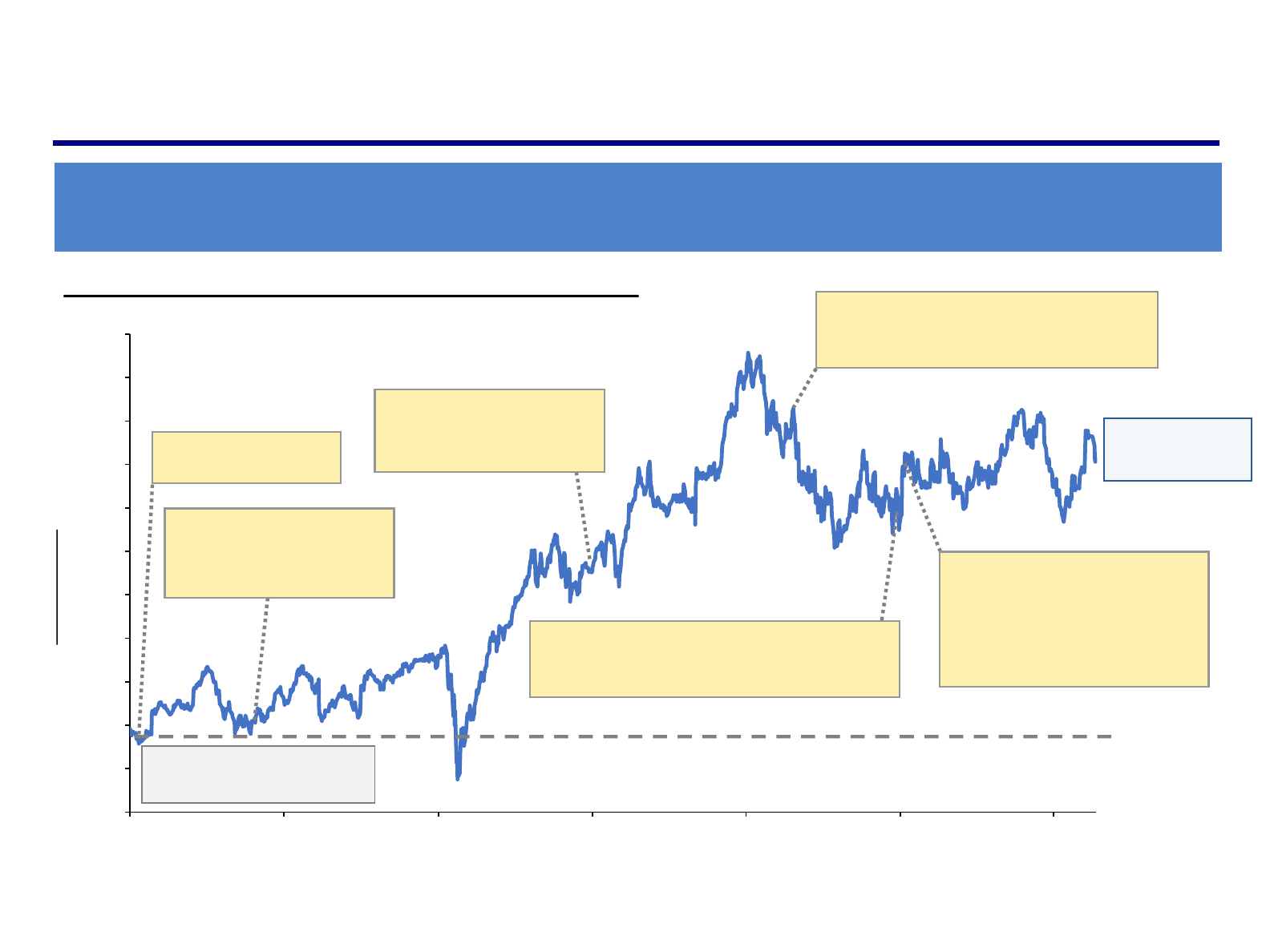

Total Debt to Total Capital Ratio Over Time

Regardless of market or portfolio volatility, PSH has continuously

maintained conservative leverage levels and investment grade ratings

9

Total Debt to Total Capital Ratio | 6/30/2015 to 12/31/2023:

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

7/25/19: Private

placement of

$400mm of 4.950%,

20-Year Unsecured

Bonds Due 2039

6/26/15: Issued

$1,000mm of 5.500%,

7-Year Unsecured

Bonds Due 2022

8/26/20: Private placement of

$200mm of 3.000%, 12-Year

Unsecured Bonds Due 2032

11/2/20: Issued $500mm of

3.250%, 10-Year Unsecured

Bonds Due 2030

10/1/21: Issued $700mm of 3.250%,

10-Year Unsecured Bonds Due 2031

and €500mm of 1.375%, 6-Year

EUR-Denominated Unsecured

Bonds Due 2027

6/15/22: Redeemed

$631mm balance of

5.500% Unsecured

Bonds Due 2022

Total Debt as % of Total Capital

10/4/21: Redeemed

$369mm of 5.500%

Unsecured Bonds

Due 2022

Note: Total Capital and the ratio of Total Debt to Total Capital are calculated in accordance with the PSH Bonds’ Indentures. Total Capital is defined as Net Asset Value plus Total Debt and is net of accrued performance fee.

(1) Assumes a 1.10x EUR/USD exchange rate for €500mm EUR-denominated bonds.

16.3%

(1)

PSH has attractive credit characteristics

Simple, transparent and highly liquid investment portfolio

Significant asset coverage: PSH debt is covered 6x by total assets

(1)

Underlying portfolio companies are diversified across industries and have relatively

low commodity exposure and cyclical risk

Proven investment strategy with a long-term track record

Facilitates opportunistic issuances

Laddered maturities from 2027 to 2039 are well matched with PSH’s

long-term investment horizon

Weighted-average maturity of 8 years; weighted-average cost of capital of 3.08%

No margin leverage

No mark-to-market covenants

Long-Term Debt Financing Strategy

10

Our ability to access low-cost, investment grade, long-term debt is an

important competitive advantage for PSH

(1) Total Assets is defined as Net Asset Value plus Total Debt as of 12/31/2023.

The board continues to believe that the most powerful driver of long-term shareholder

returns will be continued strong absolute and relative NAV performance

11

Strategies to Address the Discount

Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end

of this presentation.

(1) The 1-year, 5-year, and 10-year compound annual NAV net returns for PSH were 26.7%, 31.2%, and 13.6%, respectively. See slide 8 for further details.

(2) FTSE 100 companies ranked by market capitalization as of February 6, 2024.

(3) Reflects public and management shares outstanding as of April 30, 2017 through December 31, 2023.

(4) Ownership percentage based on current shares outstanding. Includes Pershing Square employees and affiliates and charitable entities associated with Pershing Square employees or Pershing Square affiliates.

Strong investment performance

Compound annual NAV net returns of 31.2% for the last five years

(1)

Global marketing efforts outside of the United States

Inclusion of PSH in the FTSE 100 index in December 2020. Now the 58

th

largest company by market capitalization

(2)

AIC reclassification from Hedge Funds to U.S. Equity

Retained Cadarn Capital for increased UK/European/Asian distribution and LodeRock Advisors for increased

Canadian distribution

Corporate actions

Gained premium listing on the London Stock Exchange in May 2017

PSH has repurchased 64 million shares, representing 26% of initial shares outstanding, at an average price of $20

and average discount to NAV of 29%

(3)

In 2023, PSH repurchased 5 million shares at an average price of $38 and average discount to NAV of 34%

PSCM affiliates have accumulated a 27% ownership stake through outright purchases

(4)

Initiated quarterly dividend in Q1 2019. Revised dividend policy in Q2 2022 whereby dividends now increase with NAV

Strategic Update

U.S. Listing Update

13

In 2023, we thoroughly examined the options for a U.S. listing to

increase the number of investors who can own PSH

We encountered numerous issues, including:

Issues with asset composition and relative size of merger candidates

Questions concerning trading price of newly consolidated enterprise

Limitations and restrictions due to the Investment Company Act of 1940

Adverse tax considerations

Ultimately, we decided a U.S. listing was not viable due to the above

considerations

PSH will remain a publicly-traded closed-end fund over the long term

PSH Fee Offset Arrangement

14

PSH’s original Fee Offset Arrangement (the “FOA”) was designed to reduce

PSH performance fees by an amount equal to 20% of performance fees

earned on any non-PSH capital managed by PSCM

(1)

The FOA benefit does not become effective until the $120 million of PSH’s IPO costs

borne by PSCM (the “Offset Amount”) are repaid

As of December 31, 2023, balance of the Offset Amount was $36 million

Fee offset amounts realized to-date have been limited by a material decline in

fee-paying capital at PSCM’s private funds in 2015-2018

Since the balance of the Offset Amount has not yet been reduced to zero, PSH has not

received any fee reduction benefit from the original FOA

(1) Subject to certain exceptions.

Amendments to Fee Offset Arrangement

15

As of February 7, 2024, the FOA has been amended to (1) further increase and

more immediately recognize the potential reduction in PSH performance fees, and

(2) align PSH shareholders with PSCM’s future growth

Current balance of the Offset Amount ($36 million) has been eliminated

PSH could benefit from reduced performance fees immediately, beginning in 2024

PSH to receive an additional fee reduction from 20% of management fees earned on any

Pershing Square funds that invest in public securities which do not charge

performance fees

(1)

Countercyclical benefit: Fee offsets derived from recurring management fees will have a greater relative

impact on PSH’s performance fee percentage in years with lower gross investment returns

PSH will continue to receive a fee reduction from 20% of performance fees earned on non-PSH

investment funds managed by PSCM that invest in public securities which do charge performance fees

(1)

PSCM intends to launch new investment funds which could substantially reduce PSH

performance fees over time

Registration statement for a new U.S.-listed, closed-end fund has been publicly filed with the SEC

Additional new investment funds under active consideration

1

3

2

(1) Subject to certain exceptions.

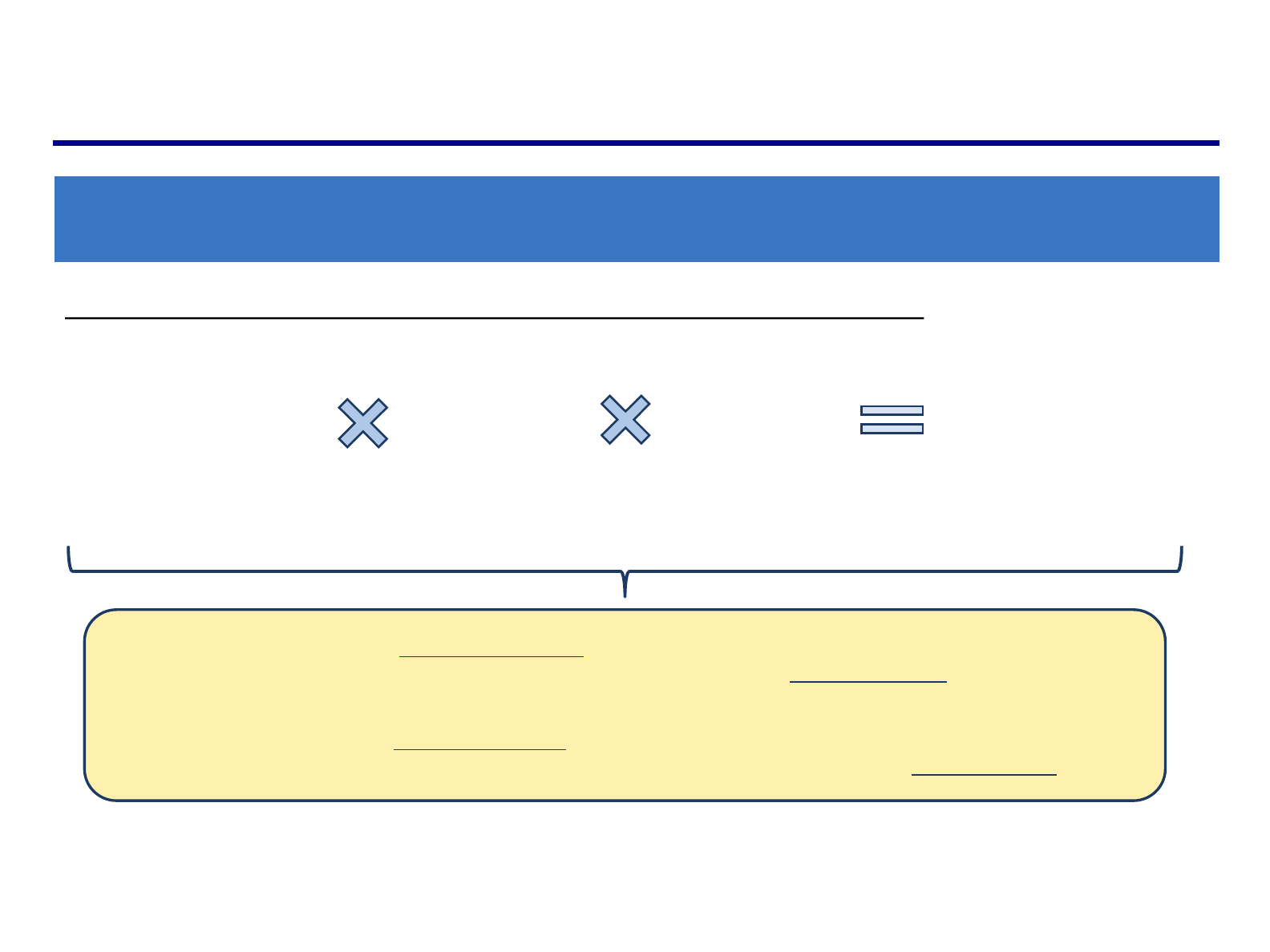

Illustrative Fee Reduction Impact

16

Through its amended FOA, PSH could realize a meaningful reduction in

performance fees as PSCM launches new investment funds

$10 billion

Illustrative AUM of New

Management Fee-Only Fund

Launched by PSCM

Illustrative Fee Reduction Impact from New Management Fee-Only Fund Launched by PSCM:

(1)

2.0%

Management Fees

As % of AUM

20%

% of New Fund’s

Management Fees

Credited to PSH

$40 million

PSH Performance Fee

Reduction Impact

Assuming PSH generates 15% gross returns, the fee offset from the illustrative new fund alone will

reduce PSH’s performance fee percentage from 16.0% to 13.5%

(2)

Assuming PSH generates 5% gross returns, the fee offset from the illustrative new fund will have an

even greater impact, reducing PSH’s performance fee percentage from 16.0% to 6.5%

(2)

Note: Calculation above is for illustrative purposes only and is not intended to give any projection of or assurance as to the amount of assets under management of any new fund launched by PSCM and the resulting impact on PSH

performance fees.

(1) Does not include any potential PSH performance fee reduction from performance fees earned from PSCM’s two private funds, Pershing Square, L.P. (“PSLP”) and Pershing Square International, Ltd. (“PSI Ltd”), or any other future

funds launched beyond the illustrative new fund highlighted above.

(2) Potential reduction of PSH’s estimated annual performance fee is based on PSH’s NAV as of December 31, 2023.

2023 Performance Review

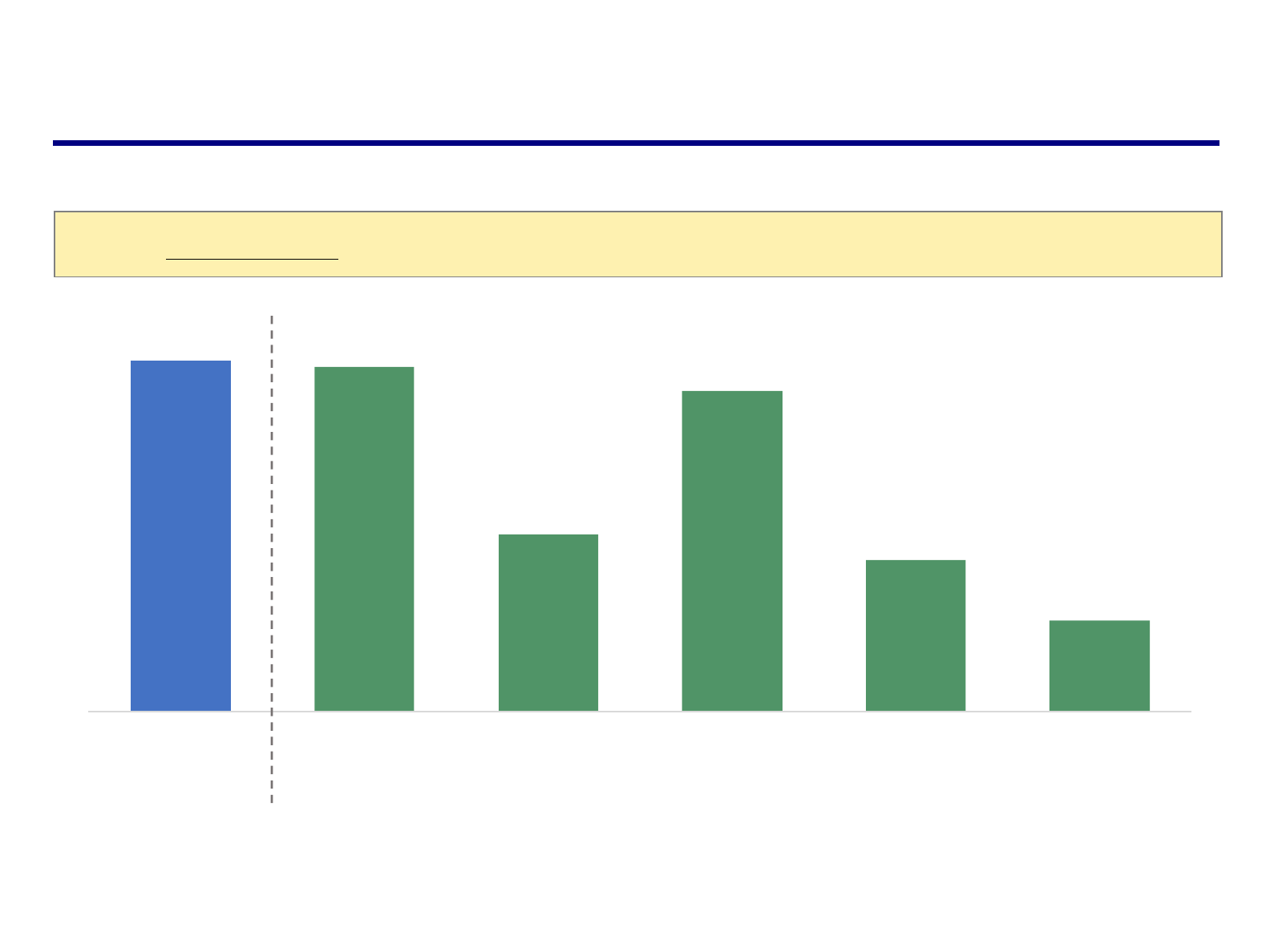

Strong Performance in 2023 Ahead of Market Indices

18

1

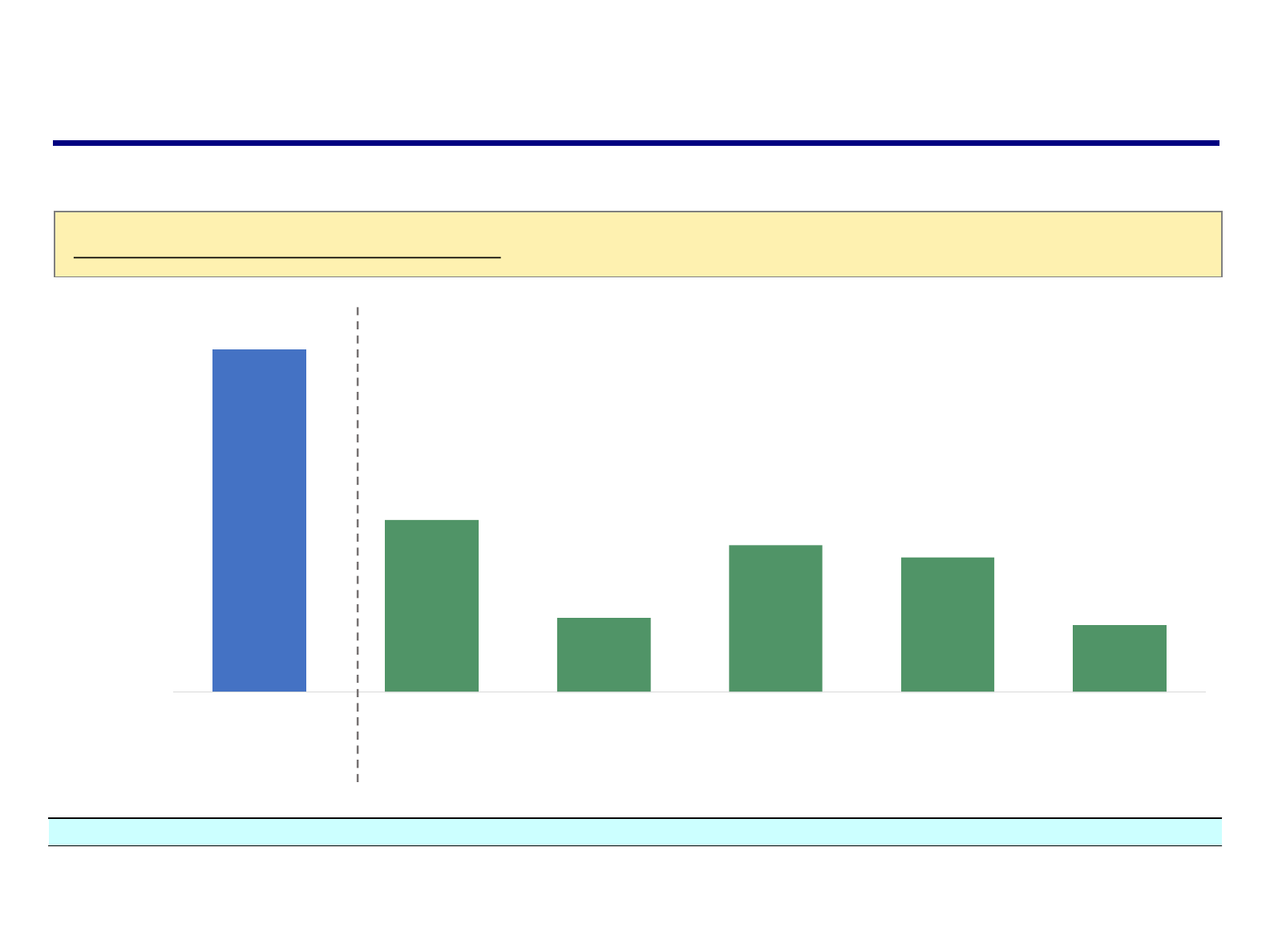

2023 Return: PSH NAV Net of Fees vs. Indices Total Return in USD

Reflects returns from 12/31/22 through 12/31/23, including dividend reinvestment for indices. Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of

principal. Please see the additional disclaimers and notes to performance results at the end of this presentation.

(1) FTSE 100 index reflects USD-denominated returns for consistency with other indices.

(2) HFRX Equity Hedge Index and HFRX Activist Index are constructed and maintained by Hedge Fund Research, Inc. HFRX Equity Hedge Index includes funds that maintain long and short positions in primarily equity and equity derivative

securities and employ a broad range of fundamental and quantitative techniques in their investment process. HFRX Activist Index includes funds with activist strategies and 50%+ of portfolio in activist situations.

26.7%

26.3%

13.5%

24.4%

11.5%

6.9%

PSH NAV S&P 500 MSCI

World

HFRX Equity

Hedge

Index

(2)

HFRX

Activist

Index

(2)

FTSE

100

(1)

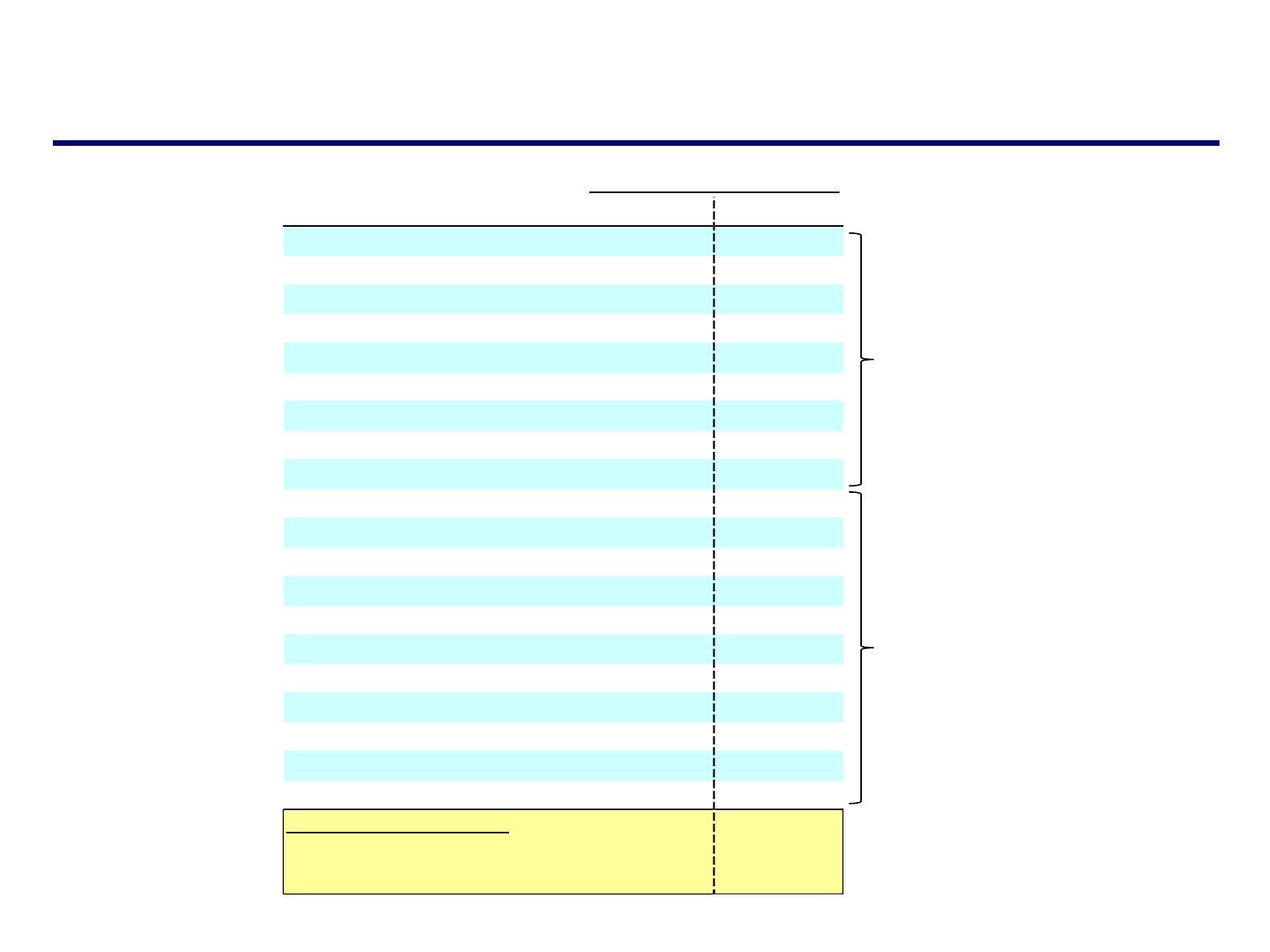

Substantial Five-Year Outperformance

19

1

5 Year Compound Annual Return: PSH NAV Net of Fees vs. Indices Total Return in USD

Reflects returns from 12/31/18 through 12/31/23, including dividend reinvestment for indices. Please refer to page 8 for PSH’s one and ten-year annualized returns. Past performance is not necessarily indicative of future results. All investments

involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end of this presentation.

(1) FTSE 100 index reflects USD-denominated returns for consistency with other indices.

(2) HFRX Equity Hedge Index and HFRX Activist Index are constructed and maintained by Hedge Fund Research, Inc. HFRX Equity Hedge Index includes funds that maintain long and short positions in primarily equity and equity derivative

securities and employ a broad range of fundamental and quantitative techniques in their investment process. HFRX Activist Index includes funds with activist strategies and 50%+ of portfolio in activist situations.

PSH Annual Outperformance: 1,550 bps 2,450 bps 1,780 bps 1,900 bps 2,510 bps

31.2%

15.7%

6.7%

13.4%

12.2%

6.1%

PSH NAV S&P 500 MSCI

World

HFRX Equity

Hedge

Index

(2)

HFRX

Activist

Index

(2)

FTSE

100

(1)

Pershing Square L.P. (“PSLP”) / PSH Annual Net Returns

20

Annual Net Returns

Year PSLP / PSH S&P 500

2004

42.6% 10.9%

2005

39.9% 4.9%

2006

22.5% 15.8%

2007

22.0% 5.5%

2008

(13.0%) (37.0%)

2009

40.6% 26.4%

2010

29.7% 15.1%

2011

(1.1%) 2.1%

2012

13.3% 16.0%

2013

9.6% 32.4%

2014

40.4% 13.7%

2015

(20.5%) 1.4%

2016

(13.5%) 11.9%

2017

(4.0%) 21.8%

2018

(0.7%) (4.4%)

2019

58.1% 31.5%

2020

70.2% 18.4%

2021

26.9% 28.7%

2022

(8.8%) (18.1%)

2023

26.7% 26.3%

Compound Annual Return

Since Firm Inception (1/1/2004)

(1)

16.4% 9.7%

Since PSH Inception (12/31/2012) 13.2% 13.7%

Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end

of this presentation.

(1) PSLP/PSH data represents returns an investor would have earned by investing in PSLP at its January 1, 2004 inception and converting to PSH at its launch on December 31, 2012.

PSLP

1.5% Management Fee,

20% Incentive Fee,

Unlevered

PSH

1.5% Management Fee,

16% Incentive Fee,

Modestly Levered

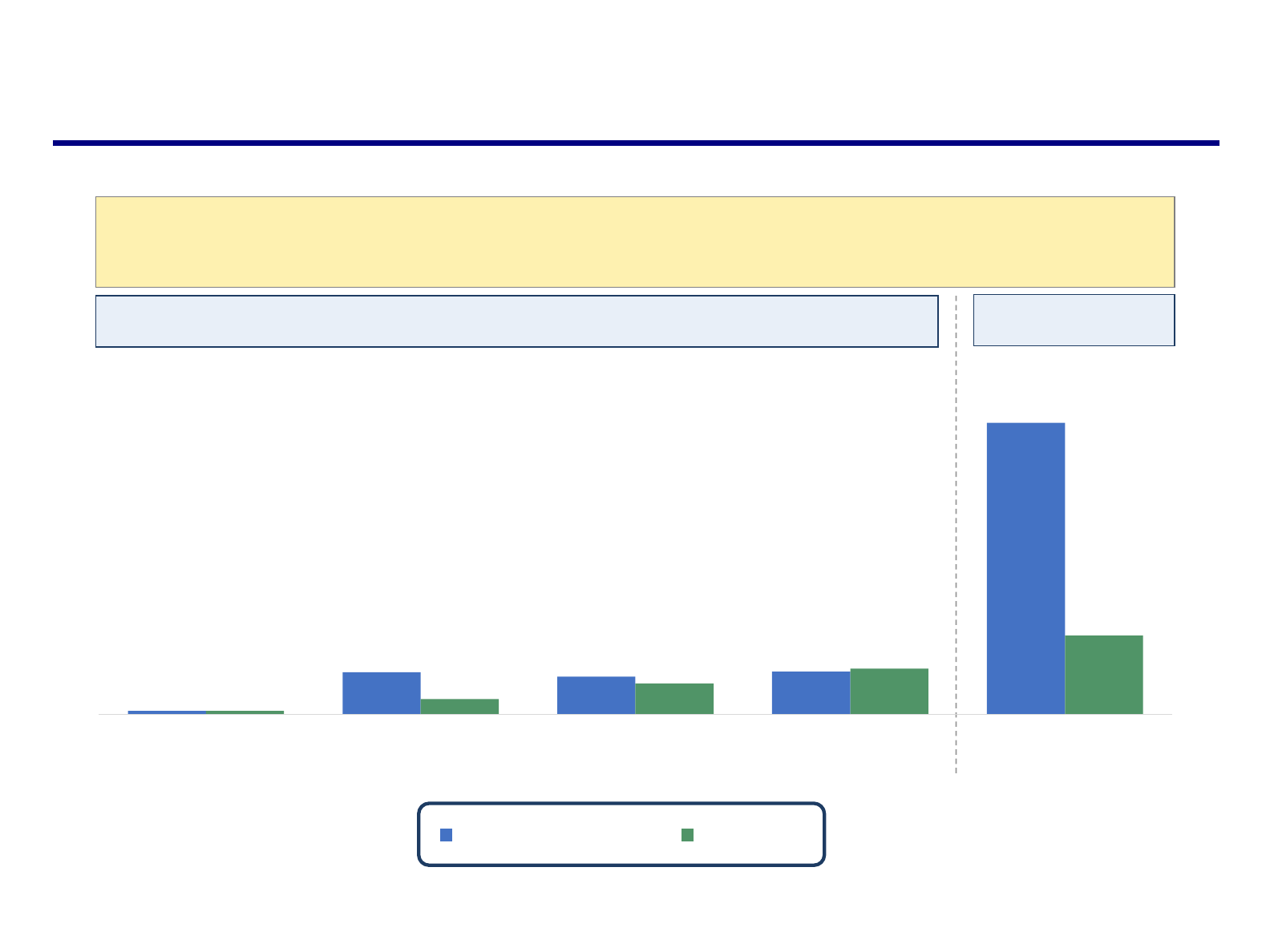

PSLP / PSH Cumulative Net Returns

21

Net Returns vs. S&P 500

through December 31, 2023

Note: PSLP/PSH data represents returns an investor would have earned by investing in PSLP at its January 1, 2004 inception and converting to PSH at its launch on December 31, 2012.

Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end

of this presentation.

PSLP / PSH

PSH

27%

289%

258%

292%

1,979%

26%

107%

211%

312%

535%

1-Year 5-Year 10-Year Since PSH Inception

(12/31/2012)

Since Firm Inception

(1/1/2004)

PSLP / PSH S&P 500

0%

200%

400%

600%

800%

1,000%

1,200%

1,400%

1,600%

1,800%

2,000%

2,200%

'04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 '23

22

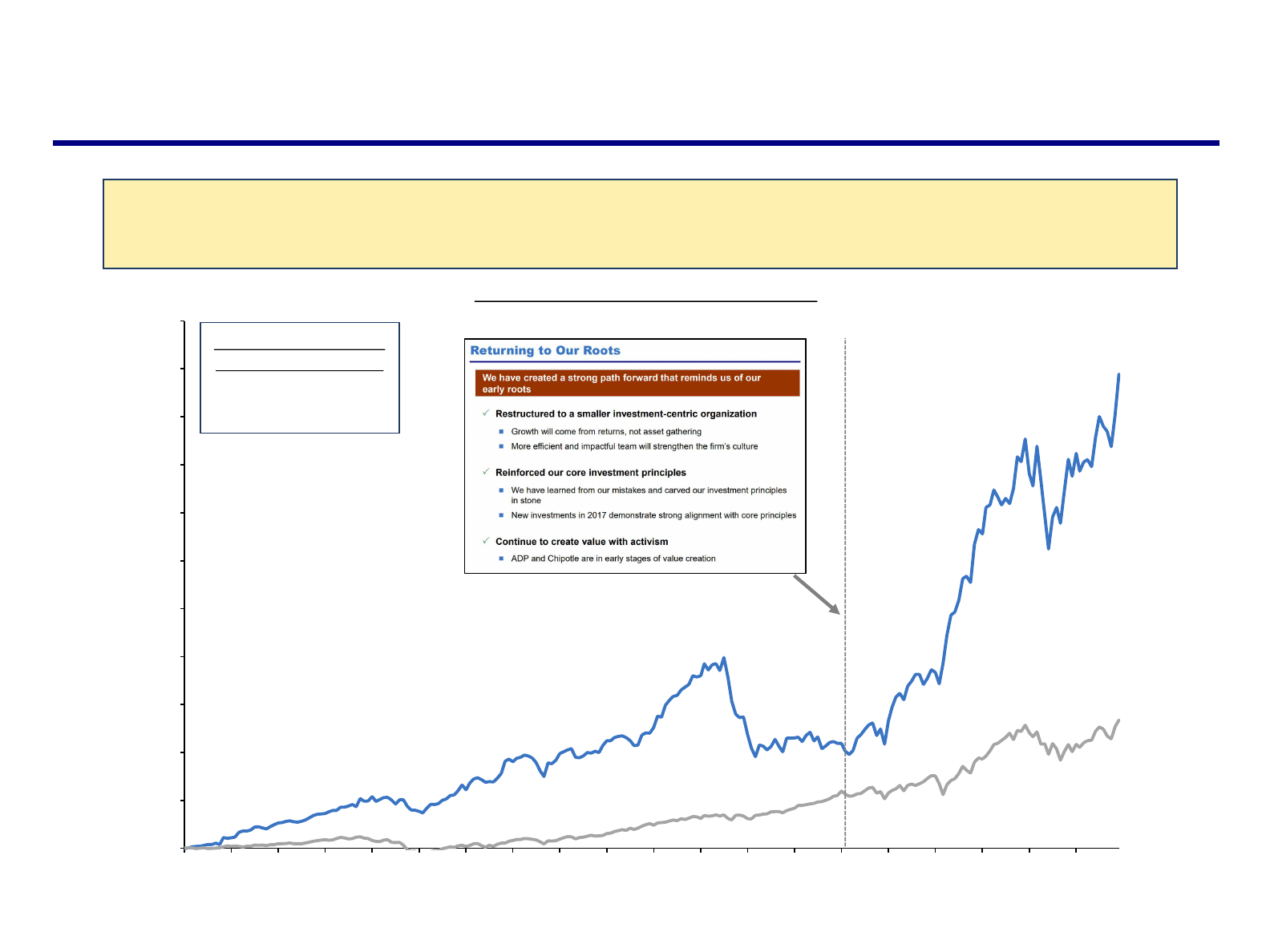

PSH Annual Investor Presentation

January 29, 2018

Cumulative Net Returns Since Inception

Note: PSLP/PSH data represents returns an investor would have earned by investing in PSLP at its January 1, 2004 inception and converting to PSH at its launch on December 31, 2012.

Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end

of this presentation.

PSLP / PSH

Since Firm Inception (1/1/04 – 12/31/23)

Since PSH Inception

(12/31/12 – 12/31/23)

PSH: 292%

S&P 500: 312%

PSLP/PSH:

1,979%

S&P 500:

535%

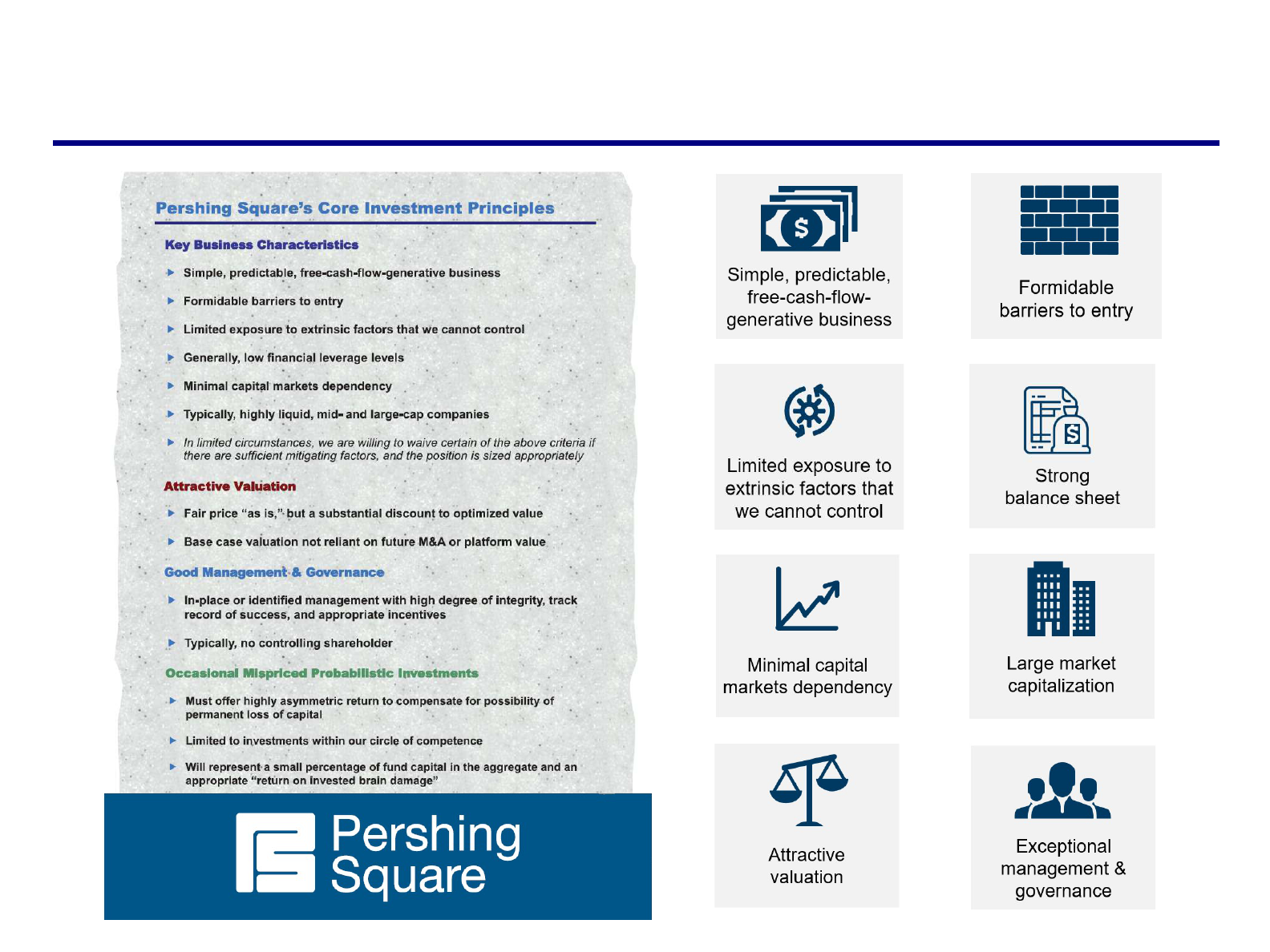

Reinforced Commitment to Core Principles

23

2023 Contributors

24

Note: Positions with contributions to performance of 50 basis points or more are listed above separately, while positions with contributions to performance of less than 50 basis points are aggregated.

Past performance is not a guarantee of future results. All investments involve risk, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end of this presentation.

(1) Net Contributors is provided solely to comply with Rule 206(4)-1 under the Investment Advisers Act of 1940 (“Advisers Act”) and related Frequently Asked Questions issued by the U.S. Securities and Exchange Commission (“SEC”). Net

Contributors reflects an adjustment to the gross return of each investment for such investment’s allocable portion of PSH’s performance fee and quarterly management fee, based on PSH’s exposure to such investment. Please see the

additional disclaimers and notes to performance results at the end of this presentation.

Contributors Gross

Net

(1)

Chipotle Mexican Grill 8.2% 7.0%

Universal Music Group 5.6% 4.7%

Alphabet 5.4% 4.6%

Hilton Worldwide 5.1% 4.3%

Restaurant Brands International 3.3% 2.8%

Lowe's 2.3% 1.9%

Howard Hughes Holdings 1.4% 1.2%

Accretion from Share Buybacks 1.1% 0.9%

Fannie Mae 0.8% 0.7%

Canadian Pacific 0.6% 0.5%

Freddie Mac 0.5% 0.4%

Total Contributors 34.3% 29.0%

2023 Detractors

25

Detractors Gross

Net

(1)

Energy Hedge (1.1%) (1.0%)

Interest Rate Swaptions (0.5%) (0.5%)

All Other Positions & Other Income / Expense (0.1%) (0.1%)

Total Detractors - Underlying Portfolio (1.7%) (1.6%)

Bond Interest Expense (0.8%) (0.7%)

Total Detractors - incl. Interest Expense (2.5%) (2.3%)

Note: Positions with contributions to performance of 50 basis points or more are listed above separately, while positions with contributions to performance of less than 50 basis points are aggregated.

Past performance is not a guarantee of future results. All investments involve risk, including the loss of principal. Please see the additional disclaimers and notes to performance results at the end of this presentation.

(1) Net Detractors is provided solely to comply with Rule 206(4)-1 under the Advisers Act of 1940 and related Frequently Asked Questions issued by the SEC. Net Detractors reflects an adjustment to the gross return of each

investment for such investment’s allocable portion of PSH’s performance fee and quarterly management fee, based on PSH’s exposure to such investment. Please see the additional disclaimers and notes to performance results at the

end of this presentation.

Total Assets Under Management

26

AUM

(1)

Insider Capital

(2)

As of 2/6/2024 ($ in millions) Total Equity

Total % of Equity

Pershing Square Holdings ("PSH") $14,591 $12,254

$3,313 27%

Pershing Square, L.P. ("PSLP") 1,410 1,410

537 38%

Pershing Square International ("PSI") 602 602

155 26%

Total Core Funds $16,604 $14,266

$4,005 28%

PS VII Funds (UMG Co-Investment Vehicle) 1,577 1,577

450 29%

Total Firm $18,181 $15,843

$4,455 28%

Note: Total Firm numbers include PS VII Master, L.P. and PS VII A International, L.P. (together, the “PSVII Funds”), which operate as co-investment vehicles investing primarily in securities of (or otherwise seeking to be exposed to the

value of securities issued by) Universal Music Group N.V. without double counting PSH’s investment in PS VII Master, L.P. As of February 6, 2024, PSH’s investment in PS VII Master, L.P. totaled $313.4M. Assets under management are

gross of any accrued performance fees. Past performance is not necessarily indicative of future results. All investments involve the possibility of profit and the risk of loss, including the loss of principal. Please see the additional disclaimers

and notes to performance results at the end of this presentation.

(1) Total AUM includes $1.8 billion and €500 million (translated to USD at the prevailing exchange rate) of PSH bond proceeds. Equity AUM excludes these amounts.

(2) Includes Pershing Square employees and affiliates and charitable entities associated with Pershing Square employees or Pershing Square affiliates.

Business and Organizational Update

28

Strong gains across the portfolio enabled PSH NAV to slightly outperform,

and PSH share price to substantially outperform, the S&P 500 in 2023

2023 Key Developments

Initiated new investment in Alphabet, the parent company of Google

Closely monitored macroeconomic developments and evaluated hedge

opportunities to protect our portfolio from downside risks

Launched Pershing Square SPARC Holdings (“SPARC”) and began search

for an attractive merger partner

Continued progress at Universal Music Group, our largest investment

Exited Lowe’s after a highly successful, nearly six-year holding period,

freeing up capital for new opportunities

Note: PSH share price performance reflects public shares traded on Euronext Amsterdam (PSH:NA) and includes dividend reinvestment.

Core Hedging Principles

29

Asymmetric payoff structures

Limited upfront investment and carrying costs

Opportunities to generate large multiples of capital

Limited downside in the event potential risk does not transpire

Monetization provides liquidity during periods of market dislocation

Hedges often become valuable when equity markets are cheap

Enables us to increase our exposure to high-quality businesses at deeply

discounted valuations

We believe our asymmetric hedging strategy is a superior alternative to a large cash position or a

continuous hedging program, both of which can be a significant drag on long-term performance

We seek to opportunistically invest in asymmetric hedges to protect our

portfolio against macroeconomic risks and capitalize on market volatility

The above is intended to be illustrative and there is no guarantee that Pershing Square will be able to identify the constituent investments or create a portfolio that reflects these characteristics.

Differentiated Macroeconomic Research Process

30

In addition to conventional top-down macro research, Pershing Square is

uniquely well-positioned to leverage perspectives from individual companies

Aggregate Government

Agency Data

Broad Survey & Sentiment

Measures

Individual Company

Results & Commentary

Real & Nominal GDP

Personal Income & Spending

CPI & PCE inflation

Employment report

Unemployment claims

Banking system & household

balance sheet data

Quarterly earnings &

conference call transcripts

Real-time views on:

-

Investment & hiring plans

-

Consumer strength

-

Price-setting behavior

-

Financial conditions

S&P & ISM PMIs

Regional Fed surveys

Fed Beige Book

Senior Loan Officer Opinion

Survey (SLOOs)

Inflation expectations

NFIB small business survey

We believe company research can yield differentiated macro insights and is highly synergistic with Pershing

Square’s core equity strategy, which has a coverage universe spanning the vast majority of S&P 500 companies

31

No initial blank check IPO; no cash is held in trust until deal closure

Special purpose acquisition rights (“SPARs”) were distributed for no consideration to former Pershing Square

Tontine Holdings shareholders and warrantholders

No “shot clock”

Up to 10 years to complete a transaction

Increased transaction certainty

Pershing Square believes it can enter into a definitive agreement in 45 days, the time required for due

diligence and negotiation

Investors opt-in to the initial business combination (“IBC”)

Reduced opportunity cost with no investor funding until a target is identified and a registration statement

becomes effective that describes in full the proposed business combination

SPARs will not be transferable or quoted until the post-effective amendment is distributed to SPAR holders

Flexible exercise price and amount of capital

Amount of capital raised can be precisely tailored to capital requirements of merger partner

Minimal frictional costs

No underwriting fees or public shareholder warrants

No conventional sponsor incentive

Pure common stock capital structure other than 20% out-of-the-money warrants on up to 4.95% of shares

outstanding for the Pershing Square funds and up to 0.154% for SPARC’s advisory board (up to 5.1% in

total)

If there are any unexercised SPARs, the amount of Sponsor Warrants will be reduced proportionately

Pershing Square SPARC Holdings (“SPARC”)

Key Highlights

Case Study: Negotiated Purchase of UMG

32

Pershing Square Tontine Holdings (“PSTH”) announced agreement to acquire

10% of UMG from Vivendi in June 2021

Followed seven months of diligence and negotiations between Pershing Square and Vivendi

Pershing Square funds assumed PSTH’s purchase obligations in July 2021

Driven by feedback received from the SEC on the proposed transaction structure, PSTH’s

board concluded that it was unlikely to receive necessary approvals in time

Completed the purchase of UMG shares ahead of schedule and on original terms

Preserved Pershing Square’s reputation for doing what we say we’re going to do

Purchase completed in September 2021 before UMG began trading as a public company

Bill joined the board of UMG in May 2022

In September 2021, Pershing Square acquired 10% of UMG from Vivendi at a

negotiated equity value of €33 billion or €18.27 per share

(1)

UMG shares have generated a total shareholder return of 58% (Net: 40%) from our

average cost at announcement, vs. a 18% return for the S&P 500

(2)

Note: The purchase of UMG is provided to demonstrate Pershing Square’s ability to identify and close a private transaction and not on the basis of performance or to indicate future returns of the investment, SPARC or the Pershing Square funds.

Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) Reflects average cost as per negotiated transaction price between Pershing Square and Vivendi and includes transaction fees. Amounts have been converted to EUR based on negotiated FX rate of 1.20 EUR to 1.00 USD.

(2) Returns are as of 2/6/2024. Net return is provided solely to comply with Rule 206(4)-1 under the Advisers Act and related Frequently Asked Questions issued by the SEC and reflects an adjustment for the (a) quarterly management fee, (b)

expenses (calculated using the expense ratio for the applicable time period), and (c) performance fee (if any) charged during relevant time period.

Limited turnover since our strategic pivot six years ago

Zero departures from the investment team since mid-2018, and one addition in September 2021

Team stability across the firm differentiates Pershing Square from the rest of the industry

Strong economies of scale with small, trusted, high-performance team

Proven ability for the existing team to enhance its competencies over time, including

macroeconomic hedging and private-to-public investing

Work-from-office culture builds trust, enables collaboration and creativity, and

helps drive strong results

Design and layout of office have proven to be valuable in a post-COVID world

Lean, collaborative, and investment-centric organization continues to

perform at the highest levels

33

Organizational Update

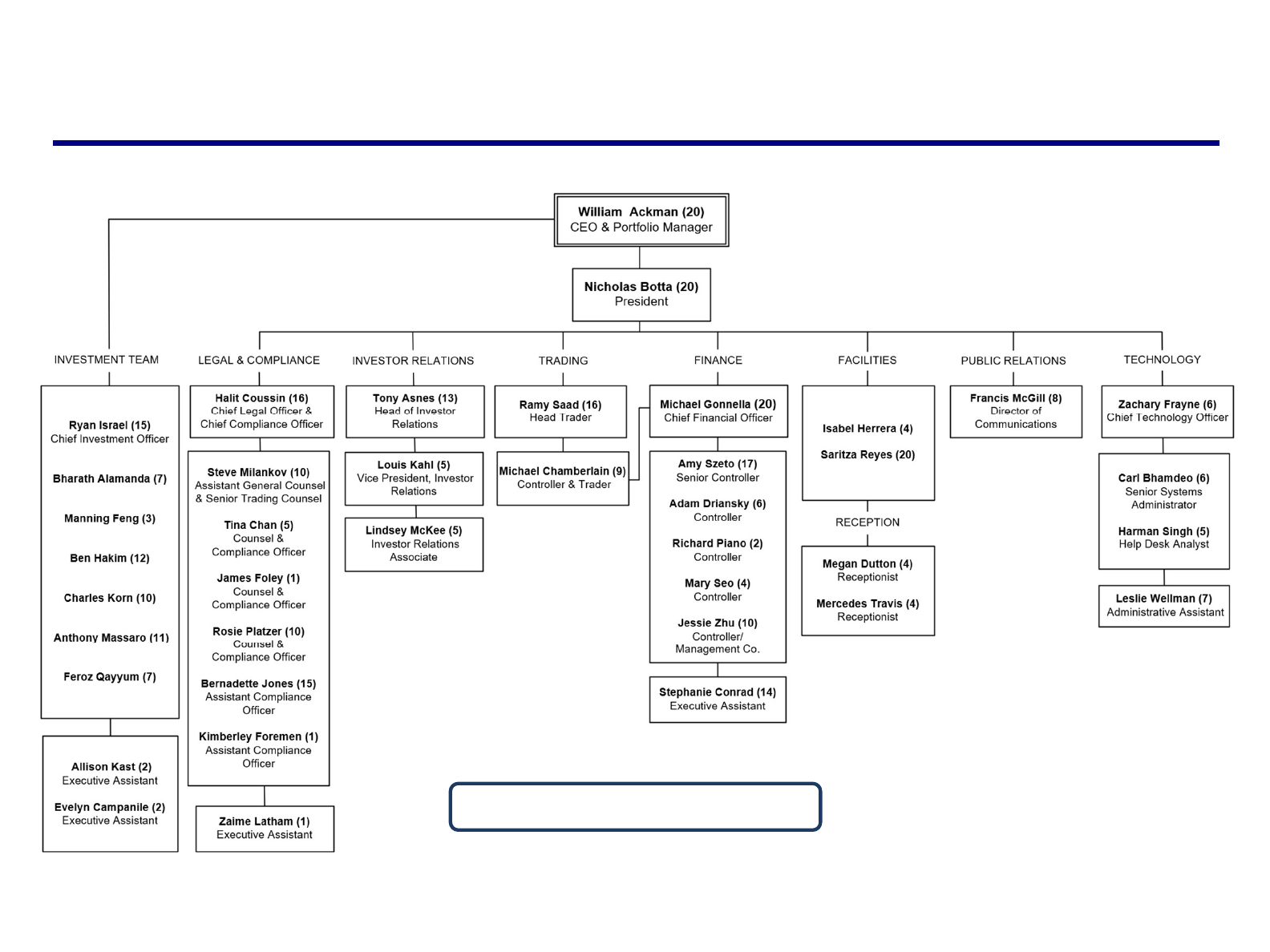

PSCM Organization Chart

34

Name (PSCM Tenure in Years)

PSCM

Tenure

(Years)

Career

Experience

(Years)

Education and Summary Prior ExperienceEmployee

2032

Gotham Partners, Co-Founder and Portfolio Manager (1992 - 2003)

M.B.A., Harvard Business School, 1992

A.B., Harvard College, magna cum laude, 1988

Bill Ackman

CEO / Portfolio Manager

1517

Goldman Sachs, Analyst (2007 - 2009)

B.S.E., The Wharton School, summa cum laude, beta gamma sigma, 2007

Ryan Israel

Chief Investment Officer

1226

The Blackstone Group, Senior Managing Director (1999 - 2012)

B.S., Cornell University, 1997

Ben Hakim

1115

Apollo Global Management, Private Equity Associate (2011 - 2013)

Goldman Sachs, Analyst (2009 - 2011)

B.S.E., The Wharton School, summa cum laude, beta gamma sigma, 2009

Anthony Massaro

1014

KKR, Private Equity Associate (2012 - 2014)

Goldman Sachs, Analyst (2010 - 2012)

B.A., The University of Western Ontario, Richard Ivey School of Business, Ivey Scholar, 2010

Charles Korn

711

KKR, Private Equity Associate (2015 - 2017)

Goldman Sachs, Analyst (2013 - 2015)

B.S.E, Princeton University, summa cum laude, phi beta kappa, 2013

Bharath Alamanda

711

Hellman & Friedman, Private Equity Associate (2015 - 2017)

Evercore, Analyst (2013 - 2015)

B.A., The University of Western Ontario, Richard Ivey School of Business, Ivey Scholar, 2013

Feroz Qayyum

38

Warburg Pincus, Private Equity Associate (2019 - 2021)

Centerview Partners, Analyst (2016 - 2019)

B.S.E., The Wharton School, summa cum laude, 2016

Manning Feng

35

Pershing Square Investment Team

Equity Portfolio Update

Music is in the early stages of higher monetization

UMG is harnessing growth opportunities from artificial intelligence

Recently enacted price increases are beginning to benefit revenues

Adoption of “artist-centric” principles will further shift royalties towards UMG

and its artists

Announced revenue-generating partnerships with Google among others

Shaping the industry by ensuring regulatory and legal protection for its artists

Opportunity for cost rationalization while maintaining industry-leading A&R

and marketing investments

Additional details to be shared with investors shortly

Universal Music Group (“UMG”)

UMG is a high-quality, capital-light, rapidly growing royalty on

greater music consumption

UMG’s cost savings plan will lead to faster profit growth

37

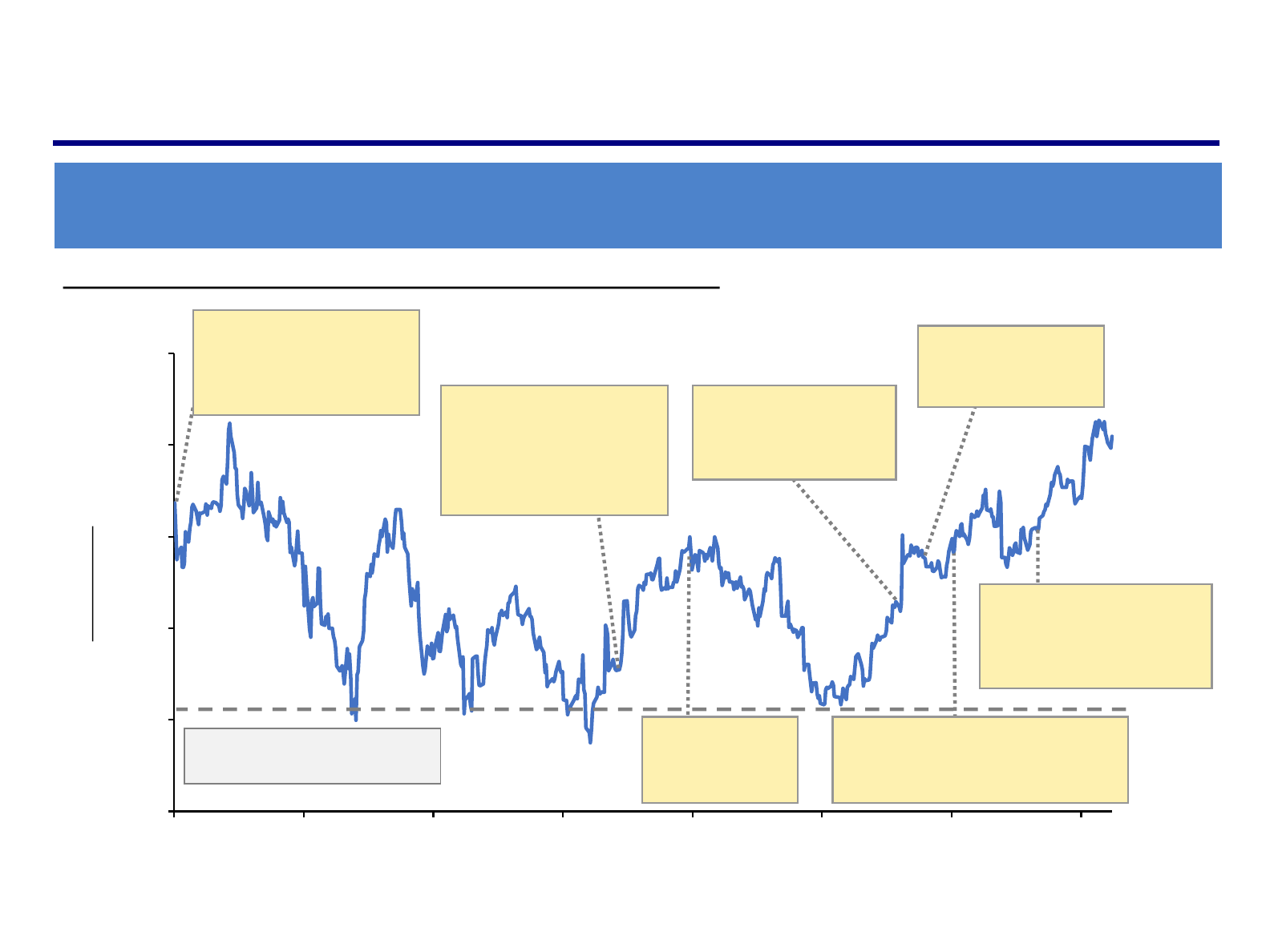

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

Given its market position and decades-long runway for sustained earnings growth, UMG’s

current valuation represents a discount to its intrinsic value

€ 15

€ 18

€ 21

€ 24

€ 27

€ 30

Sep-2021 Jan-2022 May-2022 Sep-2022 Jan-2023 May-2023 Sep-2023 Jan-2024

9/21/21: UMG completes

separation from Vivendi and

begins trading on the

Euronext Amsterdam

38

Share price

€27.28

UMG Share Price Performance from 9/21/2021 to 2/6/2024 (€EUR):

UMG’s share price including dividend reinvestment increased 17% in 2023 and

has increased 6% year-to-date in 2024

(1)

UMG Share Price Performance Since IPO

10/24/22: Apple Music

increases prices by 10% to

20%. YouTube increases its

premium family plan’s

pricing by 28%

1/19/23: Amazon

increases prices

by 10% to 20%

Note: The performance of UMG’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only UMG’s share price over time, not the value of

PSH’s investment in UMG, and is provided as context for Pershing Square’s views of UMG. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment may

differ substantially from UMG’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio for

PSLP was used) were applied to the ownership of a single share of UMG purchased at market price, including dividends without reinvestment, and held over the time period shown above, the imputed net return on that share would be 6%.

* Average cost as per negotiated transaction price between Pershing Square and Vivendi. Includes transaction fees. Based on negotiated FX rate of 1.20 EUR to 1.00 USD. Please see the additional disclaimers and notes to performance results

at the end of the presentation.

(1) As of 2/6/2024.

7/24/23: Spotify

increases prices by 6%

to 20% in 50+ markets

8/21/23: YouTube and

UMG announce joint

AI principles

9/6/23: UMG and Deezer announce

the first comprehensive artist-centric

music streaming model

11/21/23: Spotify announces

changes to royalty model to

drive $1 billion towards

professional artists

Average Negotiated

Purchase Price: €18.27*

Dominant player in secularly fast-growing global digital advertising market

Structural beneficiary of decade-long AI investment and leadership

Digital advertising well-poised to continue taking share from traditional media

Search & YouTube are two of the highest return and most resilient digital ad formats

Revenue growth in Alphabet’s core advertising business accelerated from 3% in Q1 to

10% in Q4 as the advertising market recovered

Alphabet (“GOOG”)

We invested in Alphabet in March 2023 when misplaced concerns over

the company’s AI positioning reduced its valuation to 15x earnings

Substantial margin expansion opportunity & capital return program

39

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

(1) Excludes one-time severance and real estate realignment charges.

EBIT margins expanded ~225bps in 2023 as Cloud profits reached breakeven levels

(1)

Cost control and operating leverage in under-earning segments (Cloud, YouTube)

should sustain margin expansion while Alphabet invests behind AI initiatives

Currently repurchasing ~4% of its shares on an annualized basis

AI is deeply embedded in and will continue to enhance applications including Search

and 14 other products with over 500 million users each

AI integration in advertiser tools will lead to greater ad conversion and monetization

40

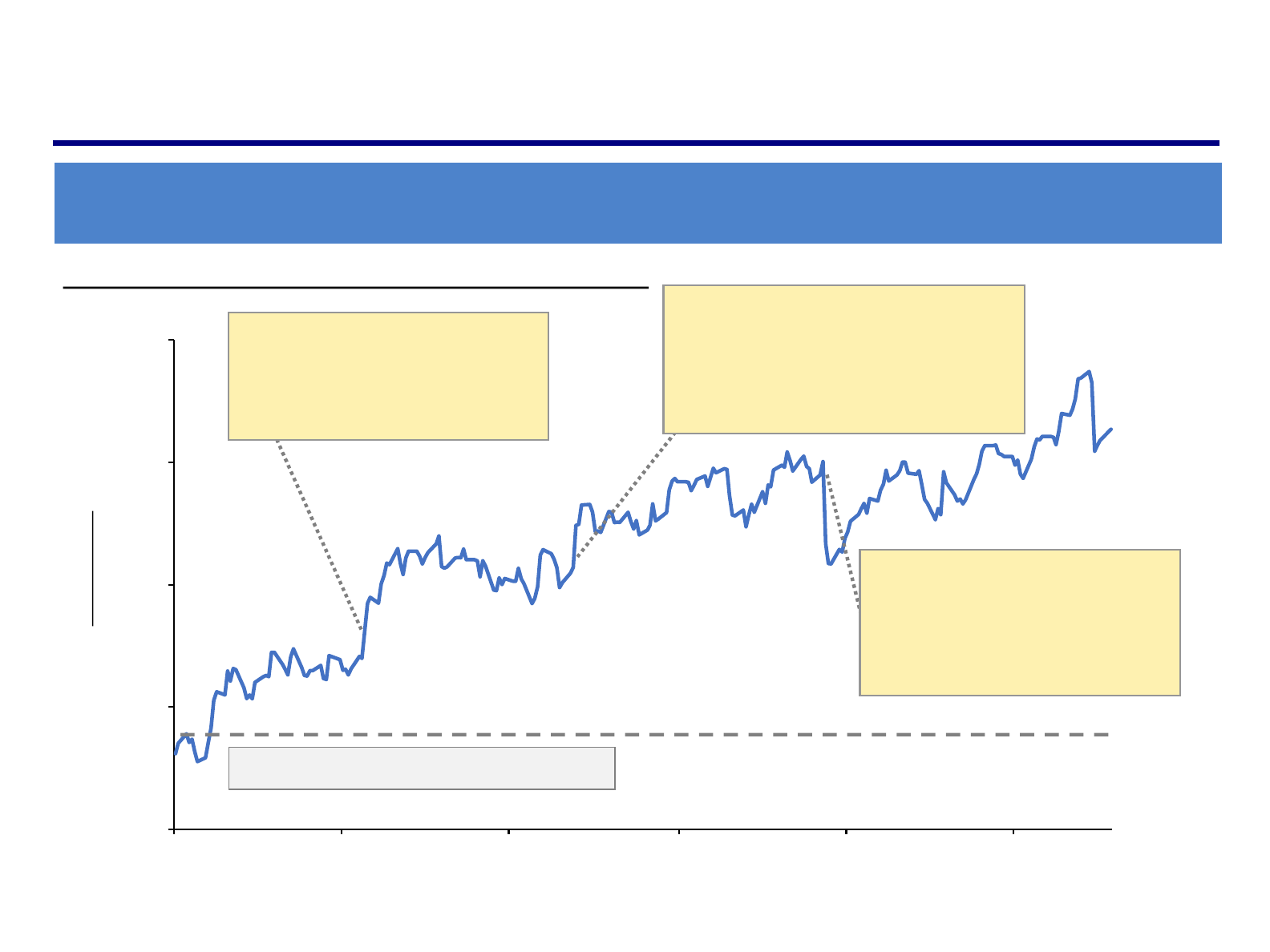

GOOG Share Price Performance Since Inception

Since inception of the position, GOOG’s share price increased 56% in 2023 and has

increased 3% year-to-date in 2024

(1)

Note: The performance of GOOG’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only GOOG’s share price over time, not the value of

PSH’s investment in GOOG, and is provided as context for Pershing Square’s views of GOOG. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment may

differ substantially from GOOG’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio for

PSLP was used) were applied to the ownership of a single share of GOOG purchased at market price, including dividends without reinvestment, and held over the time period shown above, the imputed net return on that share would be 49%.

*Weighted average cost at announcement date based on Pershing Square’s ownership of GOOG (Class C) and GOOGL (Class A). Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024. Reflects share price of GOOG (Class C). Since inception of the position, the share price of GOOGL (Class A) increased 55% in 2023 and has increased 3% year-to-date in 2024.

$80

$100

$120

$140

$160

Mar-2023 May-2023 Jul-2023 Sep-2023 Nov-2023 Jan-2024

5/11/23: Company holds its annual I/O

developer conference, unveiling its new

state-of-the-art large-language models

and showcasing a variety of ground-

breaking AI use-cases

Share price

$145

GOOG Share Price Performance from 3/2/2023 to 2/6/2024:

7/25/23: Company reports strong Q2 earnings

with revenue growth acceleration and

significant operating leverage. Announces

Ruth Porat, current CFO, will transition into a

newly created role as President and Chief

Investment Officer of Alphabet

10/24/23: Company reports solid Q3

earnings. Despite growing at a robust

22% YoY growth rate, Cloud segment

revenue slightly misses expectations

due to industry-wide customer spend

optimization efforts

Average Cost at Announcement: $94*

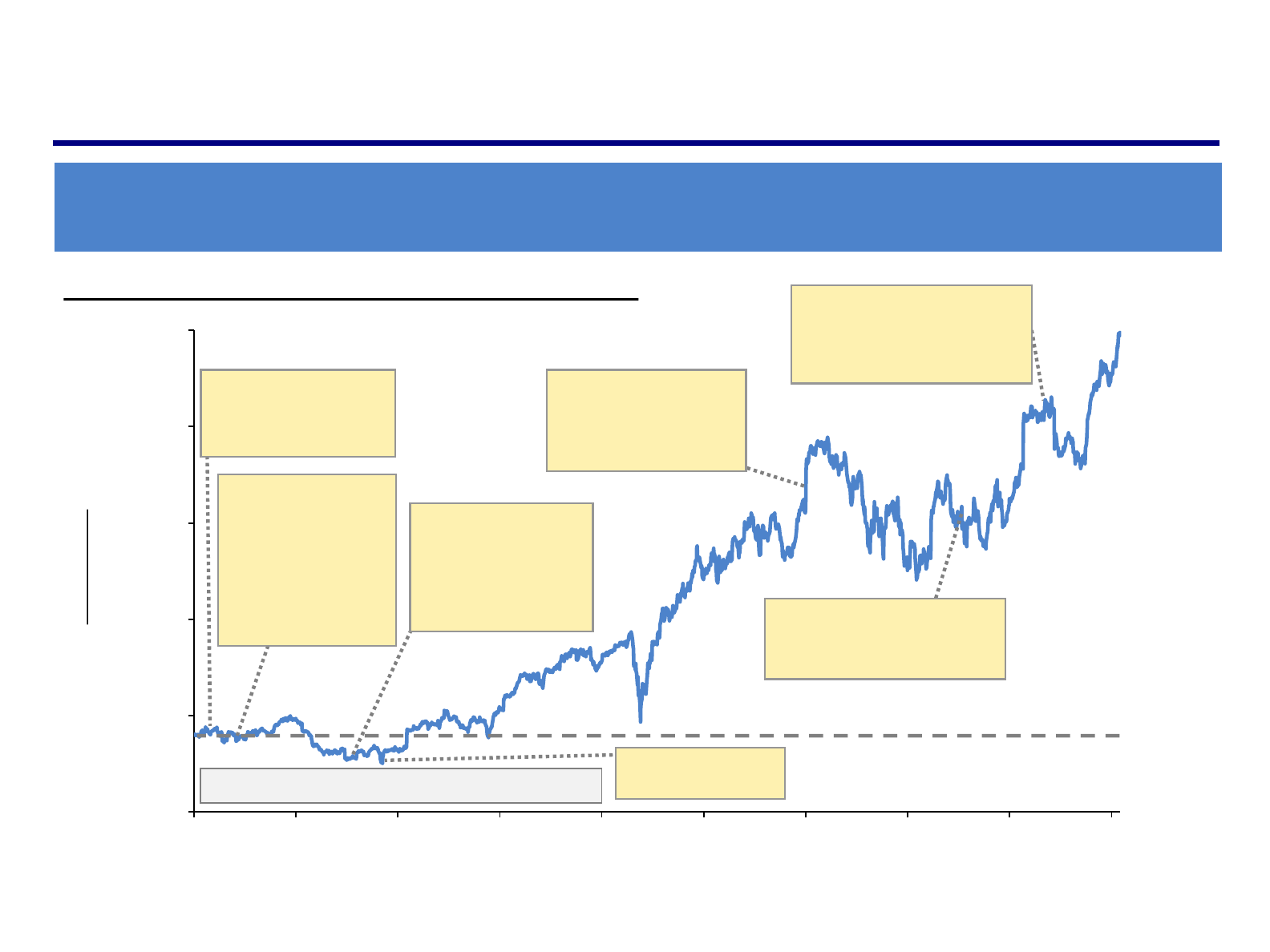

Industry-leading same-store sales growth and profitability

Same-store sales (“SSS”) grew 8% in 2023, or 42% from 2019 levels

Traffic increased 5% in 2023, driven by Chipotle’s strong value proposition, faster

throughput, and successful menu innovations

2023 restaurant margin expansion of 230bps to 26.2% underscores

Chipotle’s highly attractive unit economic model

Chipotle has a long runway for robust growth

Improve in-restaurant execution to drive SSS and profitability

New unit growth of 8% to 10% annually in North America

International expansion, including growth in Europe and new franchise

agreement in the Middle East

Long-term potential to offer breakfast and leverage automation technology

to simplify operations

Chipotle’s continued focus on exceptional food and operational

excellence fueled impressive growth in 2023

41

Chipotle Mexican Grill (“CMG”)

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

$0

$500

$1,000

$1,500

$2,000

$2,500

Aug-2016 Jun-2017 Mar-2018 Jan-2019 Nov-2019 Sep-2020 Jul-2021 May-2022 Mar-2023 Jan-2024

$2,488

9/6/16: Pershing Square

files 13D after market

close with a 9.9% stake

12/16/16: CMG

announces four new

directors added to its

board, including Ali

Namvar and Matthew

Paull from Pershing

Square

11/29/17: CMG

announces search for

new CEO; founder

Steve Ells to become

Executive Chairman

2/13/18: CMG names

Brian Niccol as CEO

42

CMG Share Price Performance From 8/4/2016 to 2/6/2024:

Share price

CMG’s share price increased 65% in 2023 and has increased 9%

year-to-date in 2024

(1)

CMG Share Price Performance Since Inception

7/20/21: Average

restaurant sales eclipse

2015 peak of $2.5mm

during Q2

Note: The performance of CMG’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only CMG’s share price over time, not the value of

PSH’s investment in CMG, and is provided as context for Pershing Square’s views of CMG. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment

may differ substantially from CMG’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio

for PSLP was used) were applied to the ownership of a single share of CMG purchased at market price and held over the time period shown above, the imputed net return on that share would be 305%.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

11/16/22: CMG opens 500

th

restaurant with a Chipotlane

digital drive-thru

7/18/23: CMG announces first-

ever franchise agreement

with Alshaya Group in the

Middle East

Average Cost at Announcement: $405*

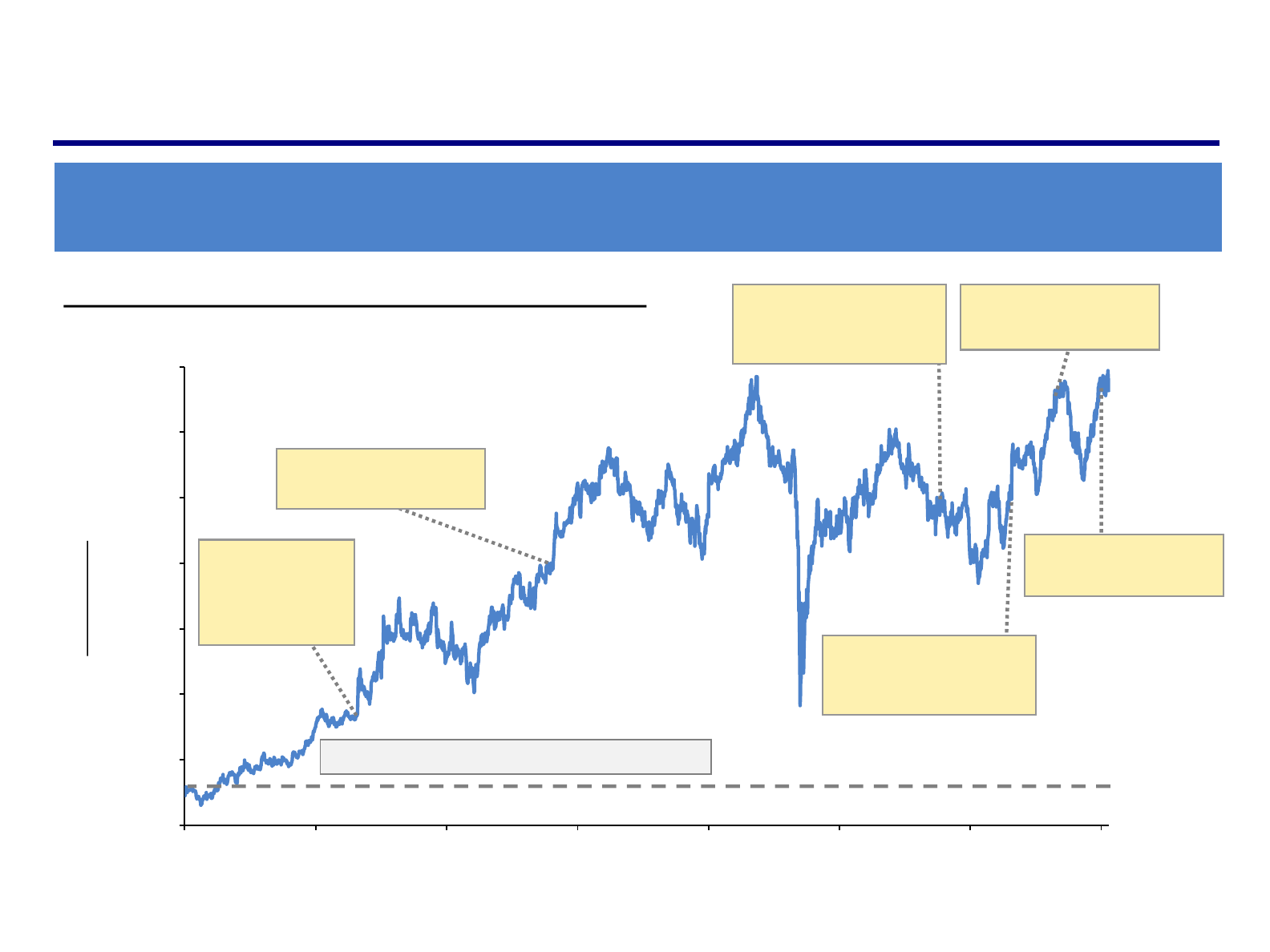

Burger King U.S. turnaround well underway and poised for acceleration

Burger King’s U.S. comparable sales have improved each quarter, despite

majority of $400mm “Fuel the Flame” program yet to be spent

Recently announced acquisition of Carrols for $1bn accelerates remodels and

refranchising to smaller operators

New reporting highlights crown jewel international business

Pure franchised royalty model with decades-long runway of unit growth

Year-to-date profits have grown by 15%

Remains cheap relative to intrinsic value and peers

Trades at 20x our estimate of 2024 free cash flow per share excluding one-time

investments at Burger King U.S.

43

Restaurant Brands International (“QSR”)

QSR is a high-quality business with significant long-term growth

potential trading at a discounted valuation

Source: Company filings, PSCM estimates, Wall Street research. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

Unit growth to accelerate

New unit growth to accelerate to historic mid-single-digit rate in 2024

44

QSR Share Price Performance Since Inception

Note: The performance of QSR’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only QSR’s share price over time, not the value of

PSH’s investment in QSR, and is provided as context for Pershing Square’s views of QSR. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment may

differ substantially from QSR’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio for

PSLP was used) were applied to the ownership of a single share of QSR purchased at market price, including dividends without reinvestment, and held over the time period shown above, the imputed net return on that share would be 267%.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

QSR’s share price including dividend reinvestment increased 25% in 2023

and has decreased 2% year-to-date in 2024

(1)

$10

$20

$30

$40

$50

$60

$70

$80

Jun-2012 Feb-2014 Oct-2015 May-2017 Jan-2019 Sep-2020 May-2022 Jan-2024

$76

8/24/14: QSR

announces

acquisition of Tim

Hortons

2/1/17: QSR announces

acquisition of Popeyes

11/15/21: QSR announces

acquisition of Firehouse

Subs

QSR Share Price Performance From 6/19/2012 to 2/6/2024:

Share price

11/16/22: QSR appoints

Patrick Doyle as

Executive Chairman

2/14/23: QSR appoints

Josh Kobza as CEO

1/16/24: QSR announces

acquisition of Carrols

Average Cost at Announcement: $16*

Hilton is a high-quality business with a long runway of strong earnings

growth led by an exceptional management team

45

Hilton Worldwide (“HLT”)

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

Strong financial performance in 2023

Average daily revenue per room (“RevPAR”) increased 13% over 2022

Earnings-per-share grew 27% YoY (now 59% above pre-COVID levels)

Industry conditions remain supportive

2024 RevPAR supported by improvement in occupancy (still below pre-COVID

levels), record group demand outlook, and strong international growth

Net unit growth poised to positively inflect in 2024

Hilton pipeline largest in history, supported by new brand concepts (Spark and H3)

HLT is well positioned for attractive long-term performance

Best-in-class value proposition drives market share increases and supports

industry leading net unit growth (“NUG”) of 6% to 7%

NUG supports high-single-digit compounded revenue growth

Expense control and buybacks support mid-teens free-cash-flow-per-share growth

$25

$50

$75

$100

$125

$150

$175

$200

Oct-2018 Jun-2019 Jan-2020 Sep-2020 May-2021 Jan-2022 Sep-2022 May-2023 Jan-2024

$195

3/10/20: HLT withdraws

2020 outlook

46

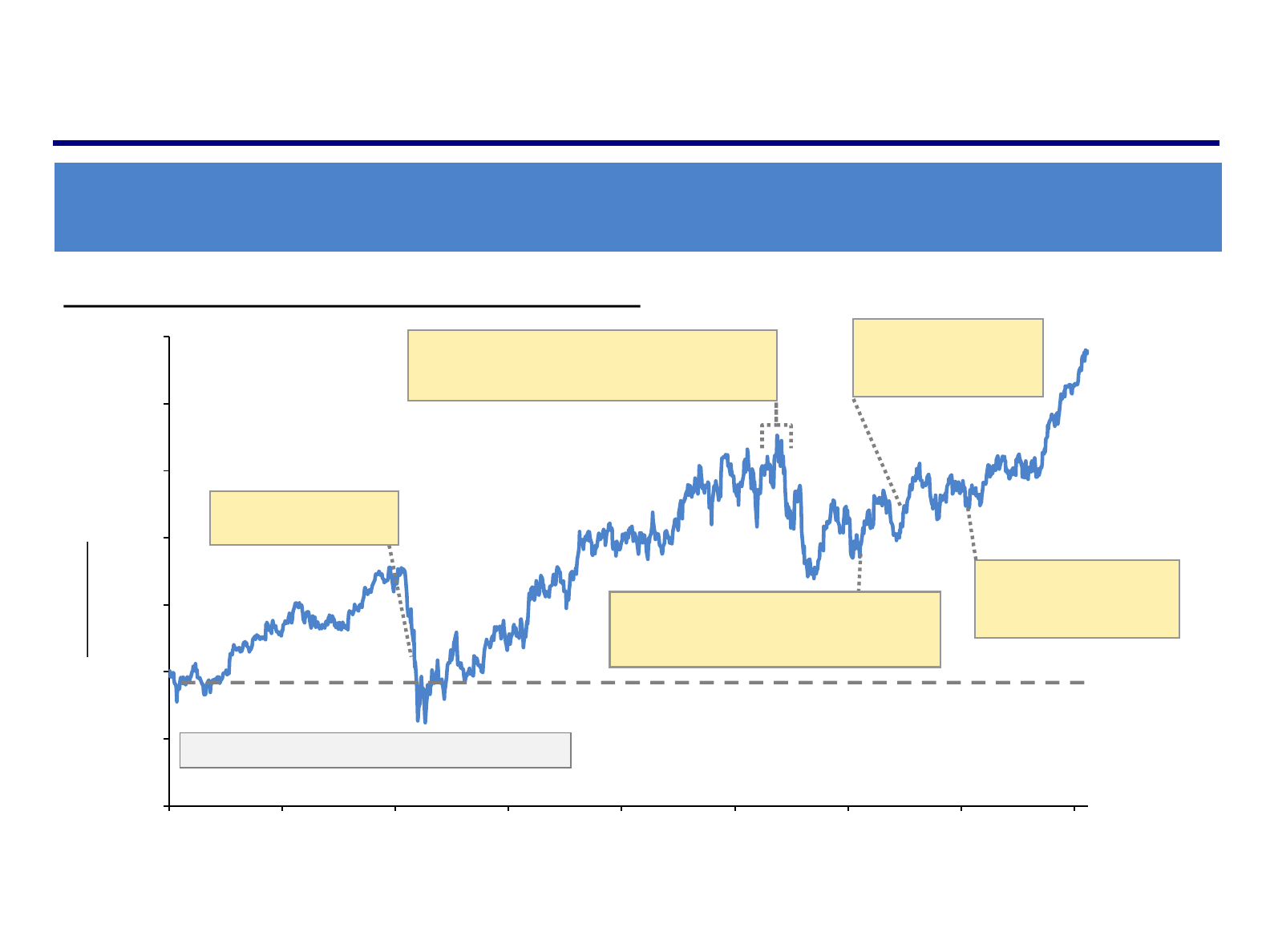

HLT Share Price Performance From 10/8/2018 to 2/6/2024:

Share price

HLT’s share price including dividend reinvestment increased 45% in 2023

and has increased 7% year-to-date in 2024

(1)

HLT Share Price Performance Since Inception

10/26/22: HLT reports first quarter with

systemwide RevPAR above 2019, despite

occupancy still not having fully recovered

April 2022: Industrywide nightly rates rise

above pre-COVID levels in response to broad-

based inflation and pent-up demand for travel

Note: The performance of HLT’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only HLT’s share price over time, not the value of

PSH’s investment in HLT, and is provided as context for Pershing Square’s views of HLT. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment may

differ substantially from HLT’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio for

PSLP was used) were applied to the ownership of a single share of HLT purchased at market price, including dividends without reinvestment, and held over the time period shown above, the imputed net return on that share would be 107%.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

1/11/23: HLT unveils

Spark by Hilton, a new

value-driven offering

5/23/23: HLT announces

apartment-style

extended stay brand

Average Cost at Announcement: $73*

47

Howard Hughes Holdings (“HHH”)

HHH’s uniquely advantaged business model of owning master planned

communities (“MPCs”) drives resilient, long-term value creation

Strong 2023 performance highlights high-quality nature of MPC portfolio

Pershing Square purchased an additional 3.0 million shares of HHH in 2023 at an average price of

$72 per share and now owns 38% of the company

Shortage of resale housing inventory has fueled robust demand for new homes

2023 MPC EBT guidance of ~$325 million will mark record year of land sale profitability

Same-store NOI growth driven by rental rate increases and strong leasing activity

Closed on $435 million in aggregate new construction loans through Q3 2023 amidst a

challenging real estate financing environment

Announced plans to spin-off newly formed Seaport Entertainment division

Includes the Seaport District in NYC, the Las Vegas Aviators baseball team and the

company’s ownership stake in Jean-Georges Restaurants

Appointed Anton Nikodemus as new CEO of Seaport Entertainment

Former President & COO MGM CityCenter with over 30 years of entertainment & hospitality

industry experience

Planned separation will further establish HHH as a pure-play MPC business

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

Nov-2010 Sep-2012 Aug-2014 Jun-2016 May-2018 Mar-2020 Feb-2022 Jan-2024

$78

6/27/19: Announces its

Board of Directors will

be conducting a detailed

review of strategic

alternatives

10/21/19: Board concludes review

process and announces

transformation plan

3/27/20: Raises $600mm of equity at $50 per

share, including $500mm from Pershing

Square, to stabilize its balance sheet

12/1/20: Announces David

O’Reilly as new CEO and Jay

Cross as new President

48

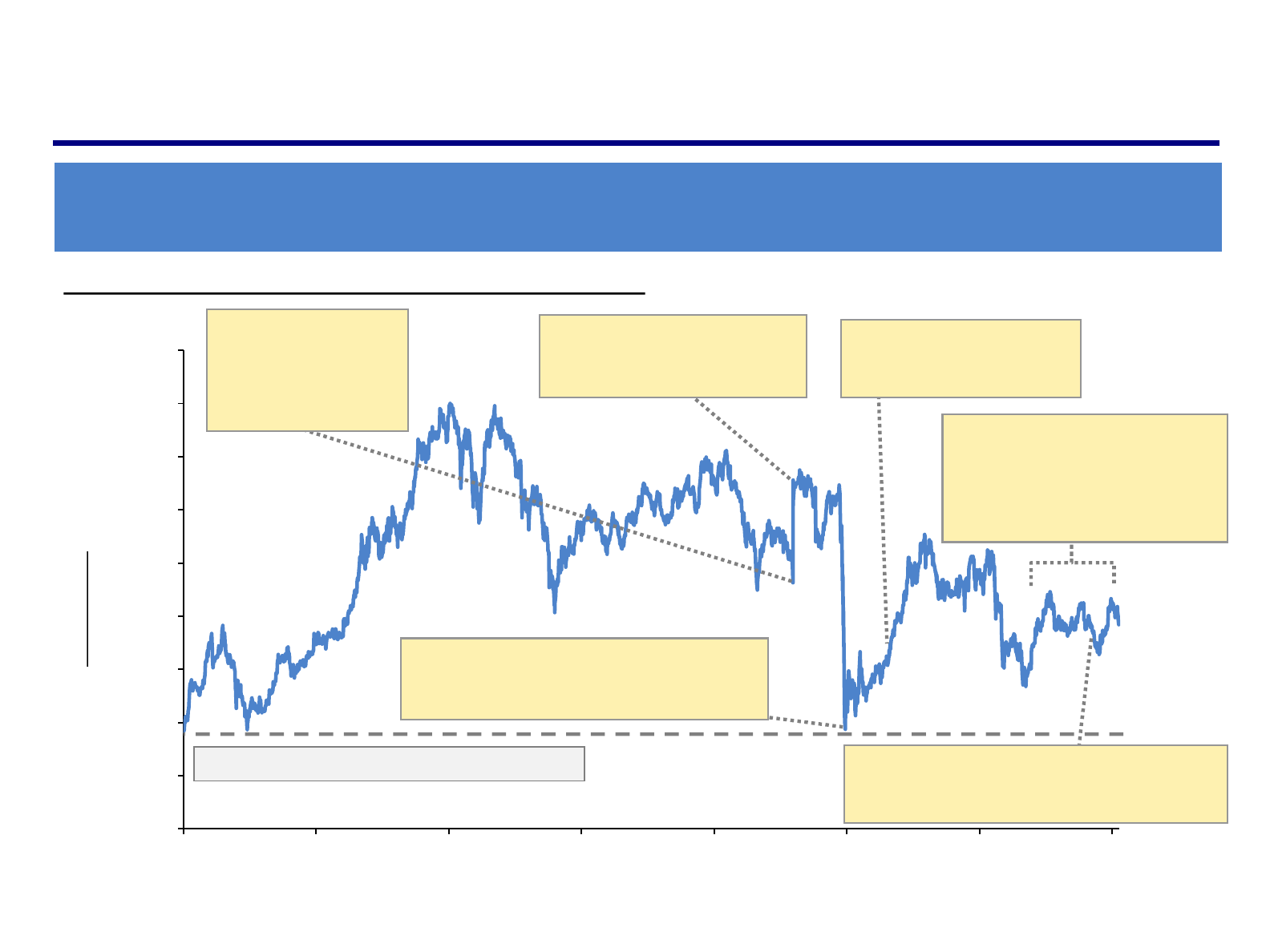

HHH Share Price Performance Since Inception

HHH’s share price increased 12% in 2023 and has decreased 9%

year-to-date in 2024

(1)

HHH Share Price Performance From 11/9/2010 to 2/6/2024:

Share price

Note: The performance of HHH’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only HHH’s share price over time, not the value of

PSH’s investment in HHH, and is provided as context for Pershing Square’s views of HHH. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment

may differ substantially from HHH’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio

for PSLP was used) were applied to the ownership of a single share of HHH purchased at market price and held over the time period shown above, the imputed net return on that share would be 23%.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

10/5/23: Announces plan to spin-off newly

formed Seaport Entertainment division and

names Anton Nikodemus as CEO of new division

11/29/22-12/11/23: Pershing Square

purchases an additional 5.2 million

shares at an average purchase

price of $72, increasing its

ownership stake in HHH to 38%

Average Cost at Announcement: $37*

High-quality, inflation-protected business model

49

Canadian Pacific Kansas City (“CPKC”)

CPKC is a unique North American railroad with significant earnings

growth potential led by an exceptional management team

Transformative acquisition creates significant shareholder value

Canadian Pacific closed its acquisition of Kansas City Southern in April

2023, creating the only railroad with a direct route from Canada to Mexico

Significant revenue and cost synergies drive accelerated earnings growth

Already exceeding management’s synergy targets despite soft demand environment

Likely beneficiary of deglobalization and North American onshoring

Line-of-sight to strong free cash flow conversion above 90%

Operates in an oligopolistic industry with significant barriers to entry

Pricing power underpins growth and provides inflation protection

Rail is often the cheapest or only viable method for transporting heavy freight over

long distances

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

The market is underestimating the long-term earnings potential of CPKC’s one-of-a-kind network

50

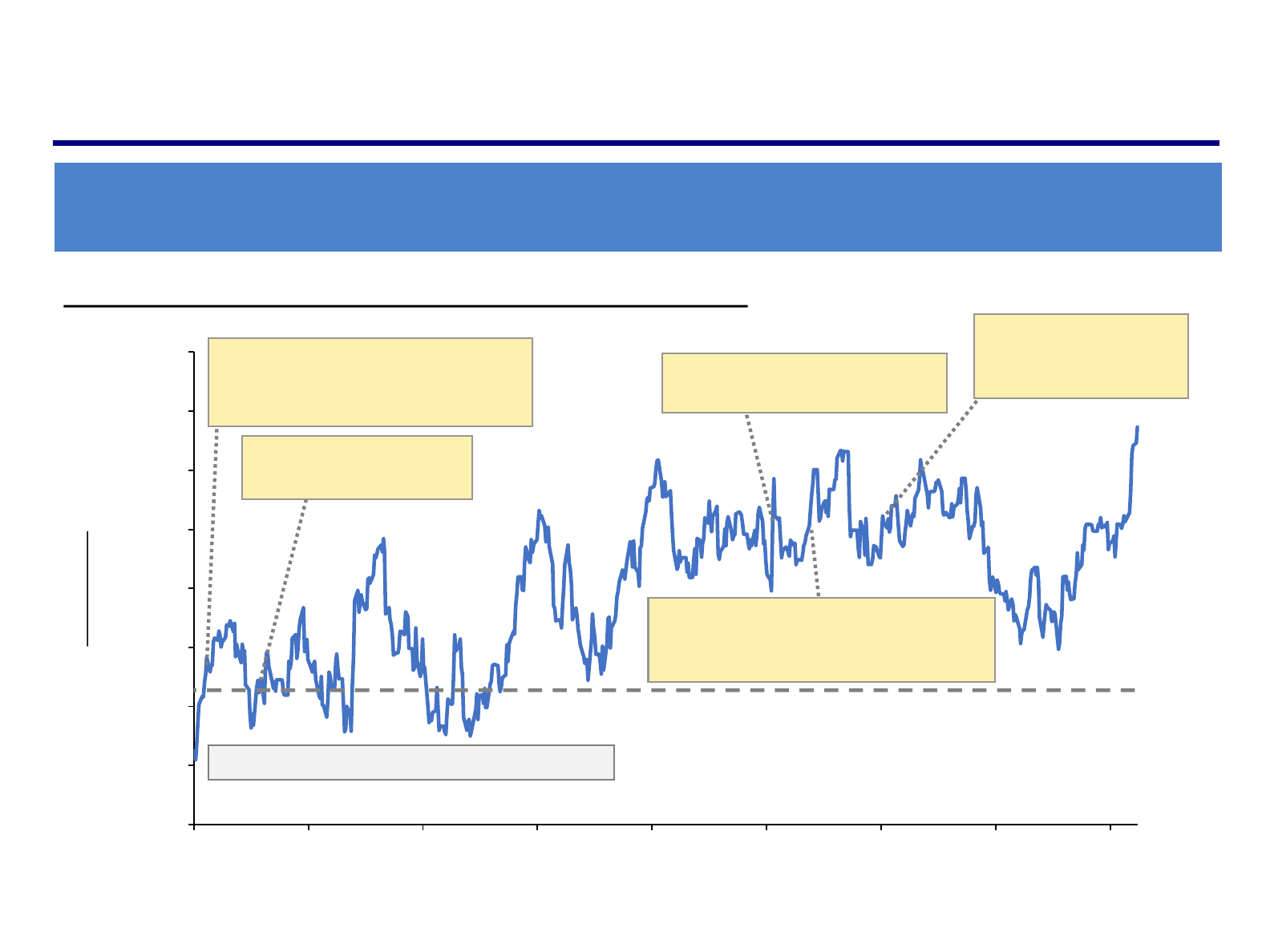

CPKC Share Price Performance Since Inception

$80

$85

$90

$95

$100

$105

$110

$115

$120

Oct-2021 Jan-2022 May-2022 Aug-2022 Nov-2022 Mar-2023 Jun-2023 Oct-2023 Jan-2024

C$114

CPKC Share Price Performance From 10/11/2021 to 2/6/2024 ($CAD):

Share price

CPKC’s share price including dividend reinvestment increased 4% in 2023

and has increased 9% year-to-date in 2024

(1)

12/14/21: CP closes KCS

acquisition into voting trust

11/23/21: Surface Transportation Board

accepts CP-KCS merger application as

complete and sets procedural schedule

Note: The performance of CP’s share price is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only CP’s share price over time, not the value of

PSH’s investment in CP, and is provided as context for Pershing Square’s views of CP. For a variety of potential reasons, such as timing of purchases and sales, use of derivative instruments, and others, PSH’s return on its investment may

differ substantially from CP’s change in share price. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year except that for years prior to PSH’s inception, the expense ratio for

PSLP was used) were applied to the ownership of a single share of CP purchased at market price, including dividends without reinvestment, and held over the time period shown above, the imputed net return on that share would be 22%.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

3/15/23: Surface Transportation

Board approves the CP-KCS merger

4/14/23: CP officially closes the acquisition

of KCS and renames the combined

company “Canadian Pacific Kansas City”

6/28/23: CPKC hosts its

inaugural Investor Day as

a combined company

Average Cost at Announcement: C$91*

We believe re-privatization is an eventuality, but may take some time

Both entities continue to build capital through retained earnings from

the current base of $118 billion

Presidential election in November 2024 may be a catalyst

Share price rally since 2022 reflects optimism around a Trump / GOP win

In August, jury awarded damages to Fannie and Freddie junior preferred

holders, as well as Freddie common holders

Preferred to recover a mid-to-high-teens percentage of current market value

Freddie common damages equate to $0.05 per share, or 5% of market value

We do not expect litigation will be the catalyst to end conservatorship

in light of Supreme Court decisions on the issue

Modest victory in shareholder class action litigation

Fannie and Freddie remain valuable perpetual options on their

potential exit from conservatorship

51

Fannie Mae (“FNMA”) and Freddie Mac (“FMCC”)

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

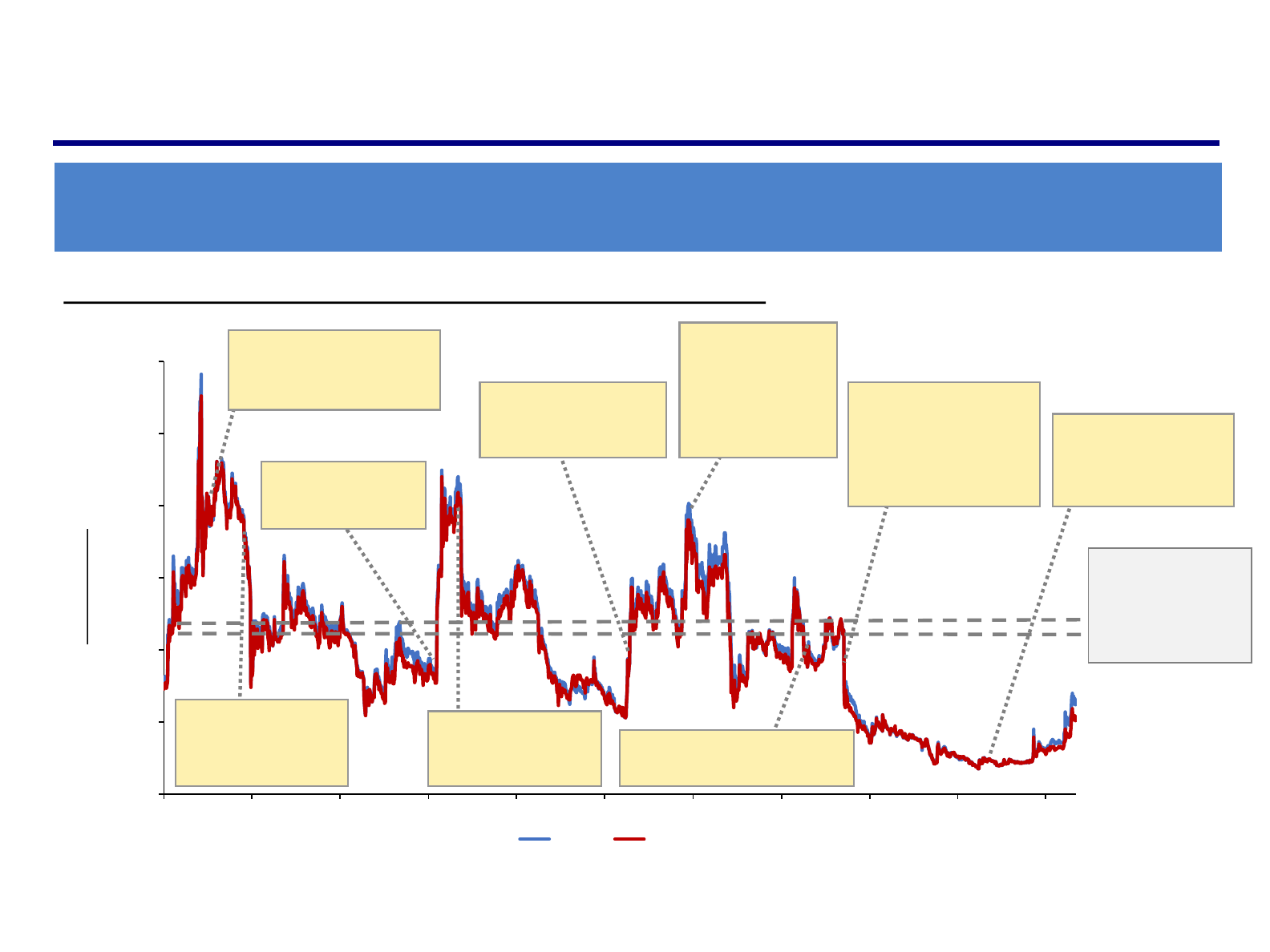

$0

$1

$2

$3

$4

$5

$6

Oct-2013 Oct-2014 Oct-2015 Oct-2016 Oct-2017 Oct-2018 Oct-2019 Oct-2020 Oct-2021 Oct-2022 Oct-2023

FNMA FMCC

5/5/14: Pershing Square

presents investment thesis

at Ira Sohn conference

9/30/14: US District

Court ruling in Perry

litigation

11/8/16: Donald

Trump wins

presidential election

2/21/17 US Court of

Appeals ruling in

Perry litigation

1/18/19: Press reports

re. FHFA plan to end

conservatorships

9/6/19: Fifth Circuit

ruling in Collins

litigation that net

worth sweep was

beyond FHFA’s

statutory authority

1/14/21: Letter agreements

suspending net worth sweep

$1.02

$1.24

52

FNMA and FMCC Share Price Performance Since Inception

FNMA and FMCC share prices increased 203% and 141%, respectively, in

2023 and have increased 16% and 20%, respectively, year-to-date in 2024

(1)

FNMA and FMCC Share Price Performance from 10/7/2013 to 2/6/2024:

Share price

Note: The performance of FNMA’s and FMCC’s share prices is provided for illustrative purposes only and is not an indication of past or future returns of the Pershing Square funds. The graph above shows only FNMA’s and FMCC’s share

prices over time, not the value of PSH’s investment in FNMA and FMCC, and is provided as context for Pershing Square’s views of FNMA and FMCC. For a variety of potential reasons, such as timing of purchases and sales, use of derivative

instruments, and others, PSH’s return on its investment may differ substantially from FNMA’s and FMCC’s change in share prices. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for

each year except that for years prior to PSH’s inception, the expense ratio for PSLP was used) were applied to the ownership of a single share of FNMA and FMCC purchased at market price and held over the time period shown above, the

imputed net return on that share would be (52%) and (58%), respectively.

*Average cost at announcement date. Please see the additional disclaimers and notes to performance results at the end of the presentation.

(1) As of 2/6/2024.

Average Cost at

Announcement:

FNMA: $2.29*

FMCC: $2.14*

1/9/23: Supreme Court

denies certiorari in

Court of Federal

Claims litigation

6/23/21: Supreme Court

issues opinion in Collins

appeal, largely siding

with the government

against shareholders

Exited Positions

Ongoing transformation should drive strong long-term earnings growth

Attractive exit valuation in light of uncertain near-term earnings trajectory

Lowe’s successfully transformed its business

Volatile near-term industry conditions present a wider band of uncertainty and

additional downside risk to same-store sales

Less “low-hanging fruit” today to offset potential revenue declines

Market share gains in Pro and omnichannel

Five-year stacked U.S. same-store sales growth increased ~32% since 2018

Expanded operating profit margins +475bps (a 55% uplift)

Earnings increased ~2.5x vs. 2018 (~$5 of EPS to ~$13)

54

Lowe’s (“LOW”)

Pershing Square exited our investment after returns became less certain amidst the current

macroeconomic environment and a wider-than-typical distribution of outcomes

Lowe’s was a highly successful investment for Pershing Square,

generating $1.8bn of profits (Net: $1.3bn) for the funds

(1)

Source: Company filings. This slide contains Pershing Square’s own views and opinions, based on publicly available information, to illustrate Pershing Square’s thinking on the matters therein.

(1) Net profits are provided to comply with Rule 206(4)-1 under the Advisers Act and related Frequently Asked Questions issued by the SEC and reflects an adjustment for the (a) quarterly management fee, (b) expenses (calculated using the

expense ratio for the applicable time period), and (c) performance fee (if any) charged during relevant time period.

$50

$70

$90

$110

$130

$150

$170

$190

$210

$230

$250

$270

Apr-2018 Mar-2019 Feb-2020 Jan-2021 Dec-2021 Nov-2022 Oct-2023

Share price

55

LOW’s share price including dividends increased 175% from our average

cost at announcement date to our average sale price

(1)

LOW Share Price Performance Since Inception

LOW Share Price Performance From 4/6/2018 to 1/5/2024:

Note: The graph above shows LOW’s share price over time and is provided as context for Pershing Square’s investment in LOW. The change in LOW's share price does not reflect PSH’s return on its investment.

(1) Total returns for Lowe’s are calculated using the Pershing Square Funds’ average acquisition cost up to the date of the position’s announcement and the Pershing Square Funds’ weighted average sale price from trades made in FQ4’23 and

include dividends. If PSH’s management fees, performance fees and fund expenses (calculated using PSH’s expense ratio for each year) were applied to the ownership of a single share of LOW purchased at PSH’s average acquisition cost,

including dividends without reinvestment, and sold at PSH’s average sales price, the imputed net return on that share would be 111%. Please see the additional disclaimers and notes to performance results at the end of the presentation.

5/22/18: Lowe’s hires

Marvin Ellison as CEO

12/12/18: LOW 2018 Analyst

Day. Introduces 12%

operating margin target

12/9/20: LOW 2020 Analyst

Day. Medium-term operating

margin target set at 13%

11/3/22: LOW announces divesture of

Canadian business to improve focus and

simplicity; reveals core US margins are ~13.6%

12/7/22: LOW 2022 Analyst Day.

Demonstrates substantial

operational progress across

many fronts. Introduces

structural margin target of 15%

US Federal Reserve begins raising interest

rates, increases in mortgage rates ensue;

existing home sales fall precipitously

Average Cost at

Announcement: $86

(1)

Average Sale

Price: $221

(1)

Q&A

57

Additional Disclaimers and Notes to Performance Results

PSH NAV appreciation is calculated with respect to PSH’s Public Shares. Results are presented on a net-of-fees basis. Net returns include the reinvestment of all dividends, interest, and capital gains from

underlying portfolio companies and assume an investor has participated in any “new issues” as such term is defined under Rules 5130 and 5131 of FINRA. Net returns also reflect the deduction of, among other

things, management fees, brokerage commissions, administrative expenses and performance allocation/fees (if any). Performance is based on the dollar return for the specific period, including any and all

dividends paid by PSH, calculated from the beginning of such period to the end of such period. Where PSH’s performance is presented with that of PSLP, results also assume that an investor invested in PSLP at its

inception on January 1, 2004 and converted to PSH at its inception on December 31, 2012. Depending on the timing of an individual investor’s specific investment in PSH and/or PSLP, net performance for an

individual investor may vary from the net performance as stated herein. 2023 Performance data is estimated and unaudited. Past performance is not a guarantee of future results.

Total shareholder return for 2023 is calculated based on PSH’s Public Shares traded on Euronext Amsterdam. Over the same period, the total shareholder return for Public Shares listed in Sterling and USD on the

London Stock Exchange was 31.6% and 32.2%, respectively. Total shareholder return for Public Shares reflects USD-denominated returns and includes dividend reinvestment.

PSH’s total debt to capital ratio is calculated in accordance with the “Total Indebtedness to Total Capital Ratio” under the PSH Bonds’ Indentures. Under the Indentures, the “Total Capital” reflects the sum of PSH’s

NAV and its “Total Indebtedness”. Total Indebtedness reflects the total “Indebtedness” of PSH and any consolidated subsidiaries (excluding any margin debt that does not exceed 10% of the Company’s total

capital), plus the proportionate amount of indebtedness of any unconsolidated subsidiary or affiliated special investment vehicle. As defined in the Indenture, “Indebtedness” reflects indebtedness (i) in respect of

borrowed money, (ii) evidenced by bonds, notes, debentures or similar instruments or letters of credit (or reimbursement agreements in respect thereof), representing capital lease obligations, (iv) representing the

balance deferred and unpaid of the purchase price of any property or services (excluding accrued expenses and trade payables in the ordinary course of business) due more than one year after such property is

acquired or such services are completed or (v) in respect of capital stock that is repayable or redeemable, pursuant to a sinking fund obligation or otherwise, or preferred stock of any of PSH’s future subsidiaries.

Indebtedness does not include, among other things, NAV attributable to any management shares or hedging obligations or other derivative transactions and any obligation to return collateral posted by

counterparties in respect thereto.

Since May 1, 2017, PSH has, from time to time, engaged in share repurchases whereby its buyback agent has repurchased Public Shares subject to certain limitations. Any positive impact on performance due to

these share buybacks is reflected herein.

In certain slides, PSLP’s net performance results are presented as it is the Pershing Square fund with the longest track record and substantially the same investment strategy to PSH. The inception date for PSLP is

January 1, 2004. PSLP’s net returns for 2004 were calculated net of a $1.5 million (approximately 3.9%) annual management fee and performance allocation equal to 20% above a 6% hurdle, in accordance with the

terms of the limited partnership agreement of PSLP then in effect. That limited partnership agreement was later amended to provide for a 1.5% annual management fee and 20% performance allocation effective

January 1, 2005. The net returns PSLP set out in this document reflect the different fee arrangements in 2004, and subsequently. In addition, pursuant to a separate agreement, in 2004 the sole unaffiliated limited

partner paid Pershing Square an additional $840,000 for overhead expenses in connection with services provided unrelated to PSLP which have not been taken into account in determining PSLP’s net returns. To

the extent such overhead expenses had been included in fund expenses, net returns would have been lower.

The market indices shown in this presentation have been selected for purposes of comparing the performance of an investment in PSH with certain broad-based benchmarks. The statistical data regarding these

indices has been obtained from Bloomberg and the returns are calculated assuming all dividends are reinvested. The S&P 500 Index, FTSE 100 Index, and MSCI World Index are not subject to any of the fees or

expenses to which PSH is subject, while the HFRX ED: Activist Index and HFRX Equity Hedge Fund Index are net of fees and expenses and reflect USD-denominated returns. The funds are not restricted to

investing in those securities which comprise any of these indices, their performance may or may not correlate to any of these indices and the portfolio of the funds should not be considered a proxy for any of these

indices. The volatility of an index may materially differ from the volatility of the Pershing Square funds’ portfolio. The S&P 500 is comprised of a representative sample of 500 U.S. large-cap companies. The index is

an unmanaged, float-weighted index with each stock's weight in the index in proportion to its float, as determined by Standard & Poors. The S&P 500 index is proprietary to and is calculated, distributed and

marketed by S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC), its affiliates and/or its licensors and has been licensed for use. S&P® and S&P 500® are registered trademarks of Standard & Poor's

Financial Services LLC. © 2023 S&P Dow Jones Indices LLC, its affiliates and/or its licensors. All rights reserved. PSH gained entry to the FTSE 100 Index (“FTSE 100”) in December 2020. The FTSE 100 is a

capitalization-weighted index of the 100 most highly capitalized companies traded on the London Stock Exchange. The equities use an investibility weighting in the index calculation. The MSCI World Index is a

broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries, covering approximately 85% of the free float-adjusted market capitalization in each country.

The HFRX ED: Activist Index is composed of hedge fund strategies with greater than 50% of the portfolio in activist positions. Activist strategies included in the index may obtain or attempt to obtain representation

of the company's board of directors in an effort to impact the firm's policies or strategic direction and in some cases may advocate activities such as division or asset sales, partial or complete corporate divestiture,

dividend or share buybacks, and changes in management. The HFRX Equity Index is composed of hedge fund strategies typically investing at least 50% of the portfolio in long or short equity positions. Hedge Fund

Research, Inc. is the sponsor and the source of the information on HFRX indices provided in this presentation. The HFRX ED Activist Index and the HFRX Equity Index are being used under license from Hedge